Artificial Intelligence in Wealth Management: BuddyX Revolutionizes Investment Advice

Christian Paulus

23 Jan 2024

Artificial Intelligence (AI) is revolutionising not just our daily lives but also the finance sector. Particularly in Wealth Management, intelligence—whether human or artificial—plays a crucial role. AI acts as a powerful tool that complements human work, automates administrative tasks, and simplifies complex processes.

Fincite has recognised this transformative technology and developed a digital assistant called “BuddyX” that helps advisors work smarter. The AI-driven features of BuddyX allow wealth advisors to work more efficiently and focus on what matters most: the relationship with the client.

How AI Brings Intelligence to Financial Consulting

The Fusion of Human and Artificial Intelligence

In Wealth Management, intelligence is often defined by experience, knowledge, and data analysis. Artificial Intelligence enhances these capabilities by analysing large volumes of data in real-time, recognising patterns, and generating targeted recommendations. BuddyX takes it a step further: The AI personalises financial solutions tailored to the individual needs of each client.

With BuddyX, the advisor's intelligence is enhanced with AI-supported assistance. This means advisors can save time and achieve qualitatively better results for their clients.

What Makes BuddyX So Special?

Efficiency Through AI-Driven Processes

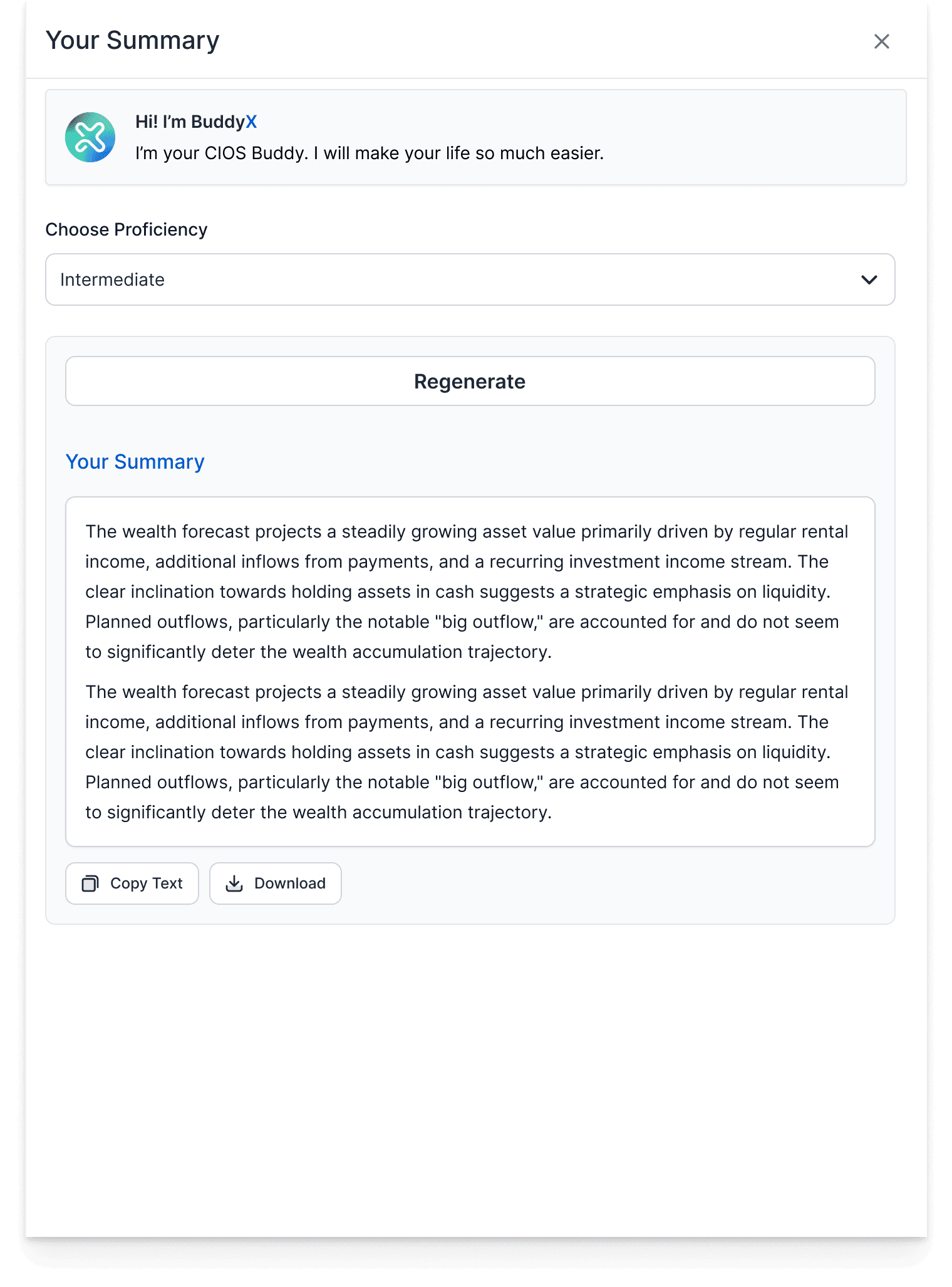

BuddyX is specifically designed for Wealth Management. It simplifies the creation of personalised email templates and PDF documents—based on client conversations. This allows clients to quickly receive detailed and customised advisory results.

The unique aspect: BuddyX ensures that reports are understandable for every client. The adaptation to the client's individual financial knowledge, whether through concise bullet points or detailed explanations, makes the difference.

Value Added Through Wealth Forecasts

Lifetime Moments in Financial Planning

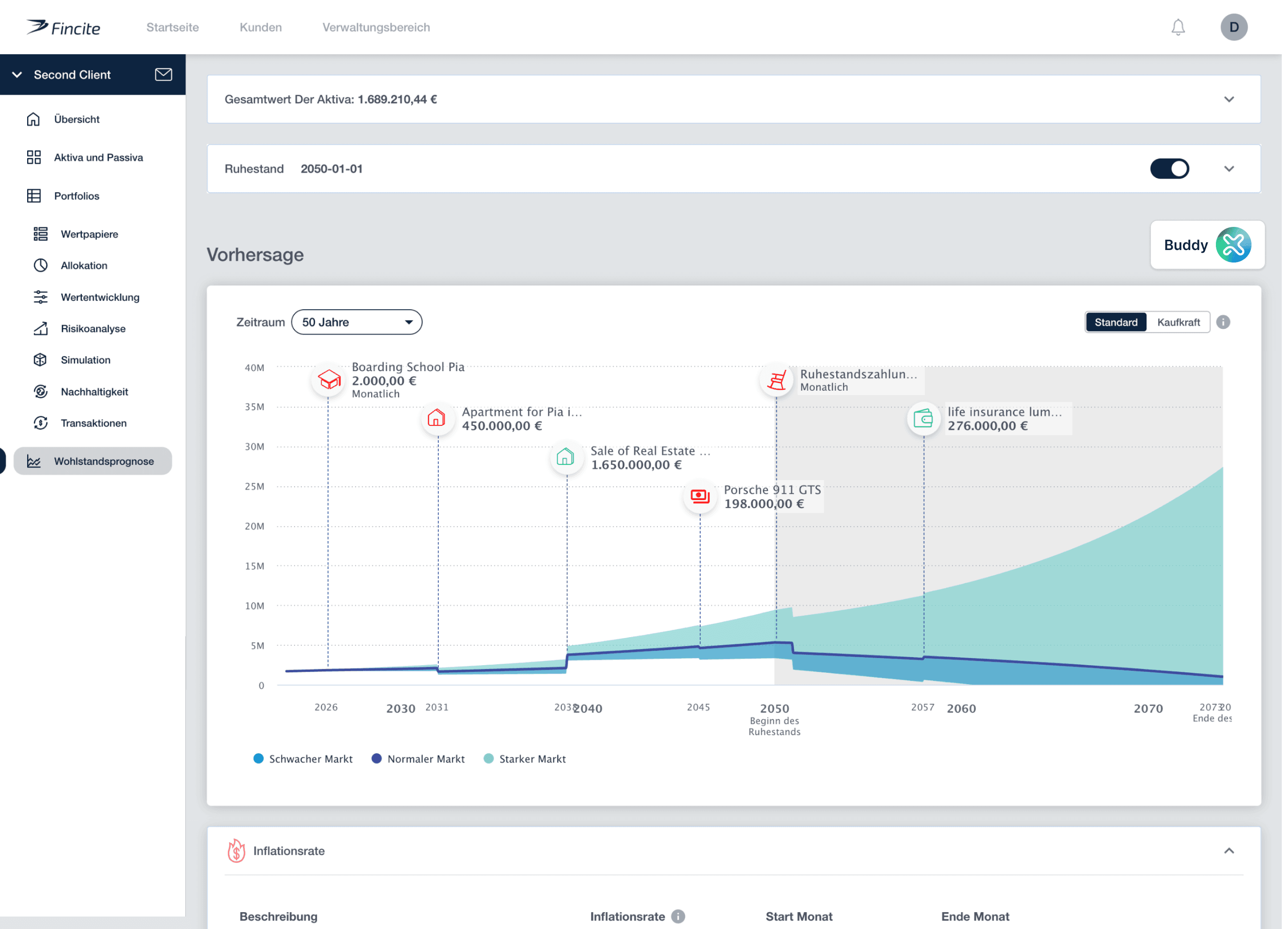

A highlight of fincite • cios is the “Lifetime Moments” strategy. Here, advisors work with their clients to create a comprehensive wealth forecast that considers important life events such as weddings or retirement. BuddyX digitises meeting notes and generates precise summaries with just a few clicks.

Data Protection Compliant and Flexible

BuddyX offers maximum security through EU hosting and meets the highest data protection standards. Additionally, the AI-agnostic technology enables the integration of various systems, tailored to the individual needs of Fincite clients.

Why Advisors Should Rely on BuddyX

Time Savings and Compliance

With increasing demands, there is also a growing need for efficient solutions. BuddyX automates time-consuming tasks, allowing advisors to focus on the individual needs of their clients. The tool ensures accuracy and adherence to all compliance regulations.

Why Intelligence is Crucial in Financial Planning

In Wealth Management, informed decisions often make the difference between success and failure. Intelligent technologies, such as those offered by BuddyX, help to minimise uncertainties and build trust.

With its intelligent data analysis and personalised features, BuddyX brings new perspectives to financial consulting. The integration of AI not only improves efficiency but also enhances client satisfaction through more precise and comprehensible advisory results.

Frequently Asked Questions About Artificial Intelligence in Wealth Management

What is artificial intelligence in Wealth Management?

Artificial intelligence in Wealth Management refers to the use of technologies that mimic human-like thinking to perform data analyses, generate reports, and provide personalised recommendations.

How does AI improve efficiency in Wealth Management?

AI automates time-consuming processes like the creation of wealth forecasts, reports, and compliance checks. This allows advisors to make better use of their time and focus on strategic client care.

Is artificial intelligence in Wealth Management safe?

Yes, modern AI solutions like BuddyX adhere to the strictest data protection standards and meet all compliance requirements. Data is hosted on EU servers to ensure the highest security standards.

Can AI replace human advisors?

No, AI supports human advisors but does not replace them. The technology serves as an intelligent assistant that alleviates the workload of advisors and enhances their work through more precise analyses and recommendations.

What advantages does BuddyX offer over other solutions?

BuddyX is characterised by maximum personalisation, efficiency improvement, and easy integration into existing systems. Moreover, the solution is scalable and adaptable to the individual requirements of clients.

Conclusion

The future of institutional Wealth Management lies in advanced, AI-supported financial planning software that improves advisory processes, automates compliance, and optimises client investments.

Learn more about how you can optimise your advisory process through AI and book a demo now with one of our WealthTech experts.