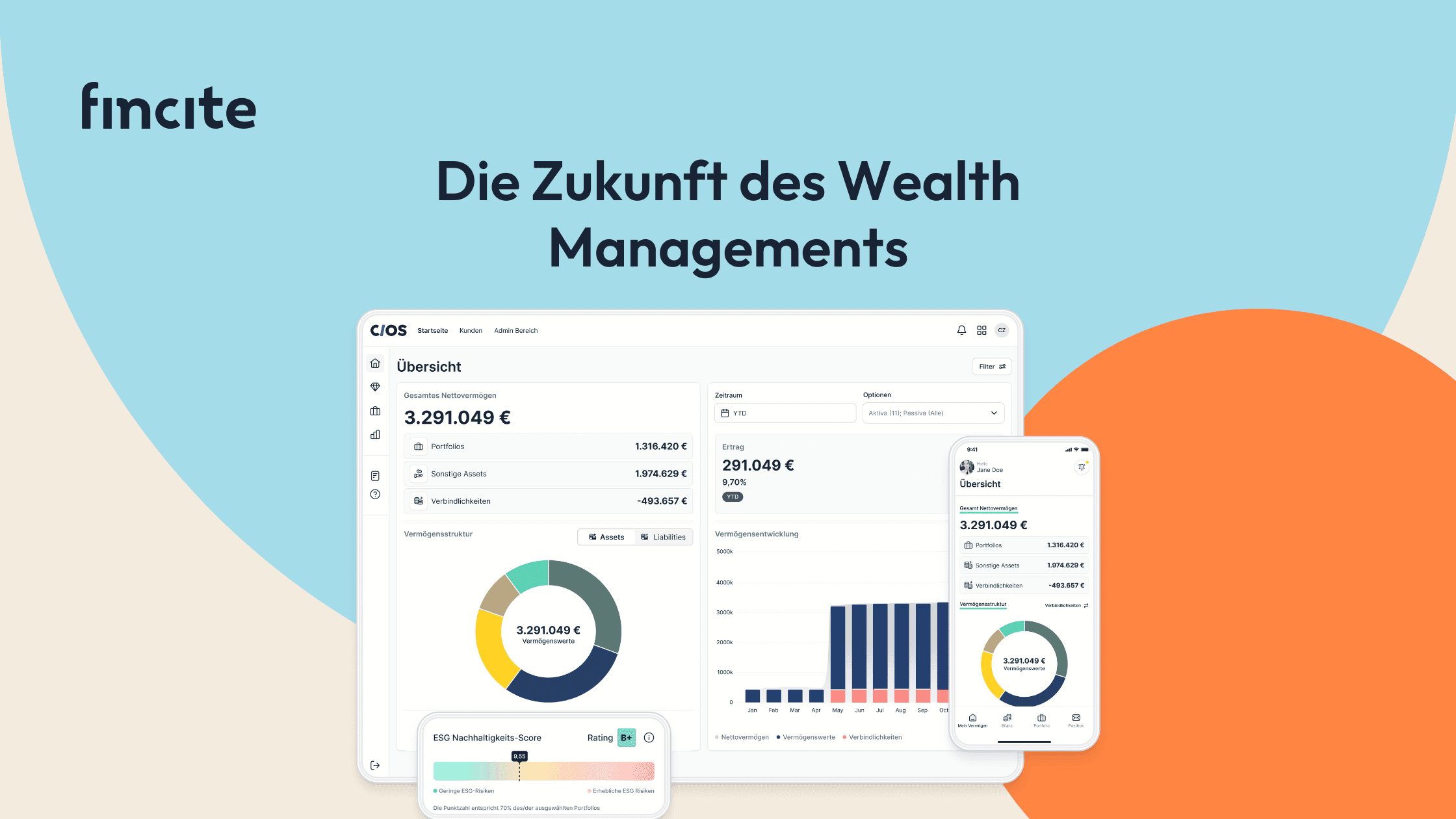

Financial Planning Software – The Future of Wealth Management for Financial Institutions

6 Feb 2025

Why Financial Planning Is More Important Than Ever for Financial Institutions

In today’s dynamic financial landscape, you need powerful software to efficiently manage complex financial structures. Financial planning software is essential for banks, asset managers, and financial advisors to optimize strategies, automate workflows, and provide data-driven investment insights to their clients.

The Role of Financial Planning Software in Investment Strategies

Effective financial planning for wealthy individuals goes beyond basic budgeting—it includes portfolio management, compliance tracking, and risk assessment. Advanced financial investment software enables you to integrate multiple client portfolios, track global market trends, and provide AI-powered investment recommendations.

Key Features and Benefits of Financial Planning Software

Automated Portfolio Aggregation: A sophisticated financial planning service consolidates all institutional assets and liabilities, providing a comprehensive financial overview.

Goal-Based Investment Strategies: You can offer tailored strategies to high-net-worth individuals and businesses to optimize financial performance and achieve long-term objectives.

Real-Time Expense and Risk Monitoring: Automated tracking helps you dynamically adjust portfolios and ensure regulatory compliance.

Regulatory Compliance: With financial planning software like fincite • cios, you can ensure your institution adheres to key regulatory frameworks such as MiFID II.

Enterprise-Grade Financial Planning: fincite • cios provides real-time financial tracking, automated rebalancing, and dynamic risk profiling to streamline advisory processes.

Client-Centric Approach: Use fincite • cios to offer AI-powered advisory services and deliver highly personalized financial strategies to your clients.

Choosing the Right Financial Planning Software for Your Institution

When selecting financial planning software, consider the following factors:

Customization & Flexibility: The software should align with your institution’s business model and regulatory requirements.

Scalability: A financial planner online should integrate seamlessly with core banking and portfolio management systems.

Compliance & Security: The software must meet strict financial industry regulations and offer enterprise-grade security.

Comprehensive Solutions: fincite • cios provides financial institutions with holistic wealth management, deep analytics, regulatory compliance (MiFID II), data-driven portfolio optimization, and a modern, dynamic UX.

Sign up now and try fincite • cios free of charge for 14 days. Transform your financial institution today!

Practical Insights for Financial Institutions

To enhance operational efficiency and client satisfaction, financial institutions should:

Leveraging AI and Automation

Automated investment solutions, such as algorithmic portfolio optimization and robo-advisory tools, enhance efficiency by reducing manual processes, analyzing market data in real time, and making optimized investment decisions automatically. This not only lowers operational costs but also enables the large-scale implementation of personalized investment strategies.

Making Data-Driven Decisions

By leveraging AI-driven analytics, financial institutions can process vast amounts of market data in real time, identify historical trends, and develop more precise risk-return models. This facilitates well-informed decision-making, allowing institutions to anticipate market movements and dynamically adjust investment strategies to evolving conditions.

Staying Ahead of Regulatory Changes

Ensuring compliance with regulatory requirements based on the documents you provide helps streamline onboarding processes according to predefined standards, ensuring full MiFID II compliance. This minimizes legal risks while maintaining operational efficiency.

Delivering Tailored Client Portfolios

AI-powered analytics enable precise segmentation of client groups based on risk profiles, investment objectives, and market behavior. This allows financial plans to be dynamically adjusted to individual needs while providing real-time, personalized investment recommendations. The result is stronger client relationships and more effective portfolio strategies.

Conclusion

The future of institutional wealth management lies in advanced, AI-powered financial planning software that enhances advisory capabilities, automates compliance, and optimizes client investments.

Fincite • cios is designed specifically for financial institutions, equipping them with cutting-edge automation, data-driven portfolio rebalancing, and seamless regulatory compliance. Whether you’re a bank, asset manager, or family office, fincite • cios provides an intelligent and scalable solution for modern financial planning.

Sign up now and try fincite • cios free of charge for 14 days. Transform your financial institution today!

Product

Clients

About us

Knowledge Hub