Investment Reporting: Efficiency and Transparency for Your Finances

Rocio de Kment

20 Feb 2024

Why Good Investment Reporting is Crucial

Good investment reporting creates transparency. It helps you better understand your clients, increases the security of all investments made, and provides new sales opportunities at the same time.

With automated processes and cloud services, you can also achieve significant cost advantages. Technological solutions not only facilitate compliance with regulations, but also provide you with real competitive advantages.

Advantages of Modern Investment Reporting

Clients benefit from a clear, user-friendly presentation and real-time access to their portfolio.

As an advisor, you can derive the next best actions for your clients, thereby increasing the AuM (Assets under Management).

The investment office gains an overview of all portfolios.

Compliance officers can monitor investment restrictions.

The private banking sector discovers new insights into net new assets and client attrition.

Investment Reporting: Definition and Target Groups

Depending on the target group, investment reporting varies significantly. Here is an overview:

Client Reporting – Added Value Through Transparency

Client reporting is appreciated by bank clients as it helps them keep track of their financial situation. It is often the only contact point outside the bank and creates a consistent interaction between you and your clients. Important content in client reporting includes:

Portfolio values and allocations

Stock and sector analysis

Summaries and details of transactions

Accumulated revenue

Risk and performance metrics

Scenario simulations

Advisor Reporting – Recommendations for More Success

An efficient advisor reporting helps you focus your attention on the right areas. You can see at a glance:

Which clients should adjust their portfolios.

Upselling potentials.

Where you can prevent client attrition.

Management Reporting – Lead Your Team More Efficiently

Management reporting focuses on optimizing internal processes and distributing the risk culture. A detailed management report answers questions such as:

How can the advisor team work more efficiently?

Who are the most profitable clients?

How can risks be identified early?

Which clients need assistance?

Technical Features of Investment Reporting

Two central forms of reporting are:

Event-Driven Reporting

This evaluates data triggered by specific events, such as reaching thresholds or performance deviations.

Time-Driven Reporting

In this function, metrics over time changes are presented, e.g., through comparisons with the previous year's values or percentage changes.

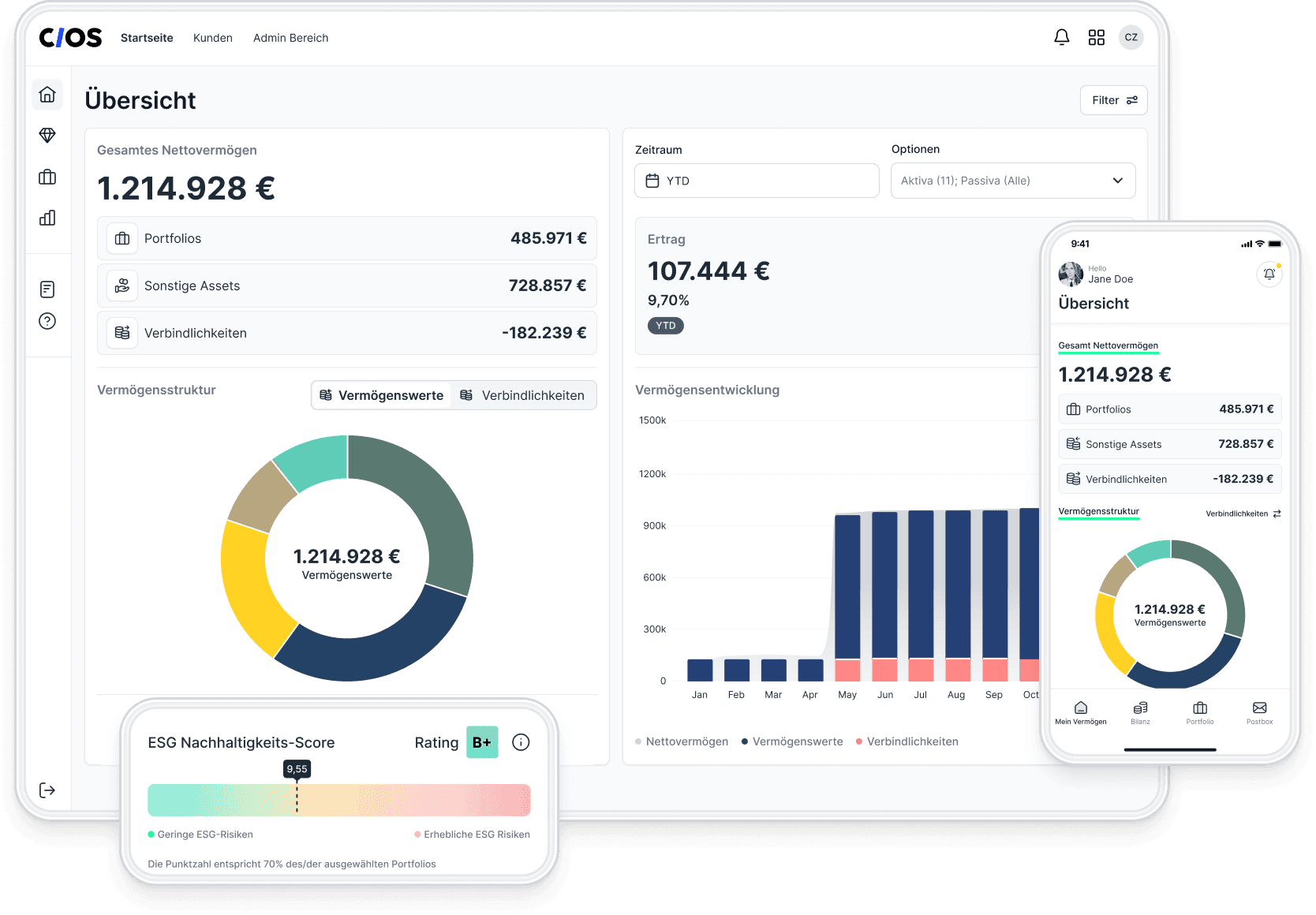

Fincite • cios – Your Solution for 360-Degree Investment Reporting

With the modular software fincite • cios, you can create a unified data foundation that links client data with market data, algorithms, and individual rules.

Benefits for Your Client Reporting

360° view with real-time information about client assets.

Clarity about risk distribution in relation to the risk profile.

Transparent overview of costs and fees.

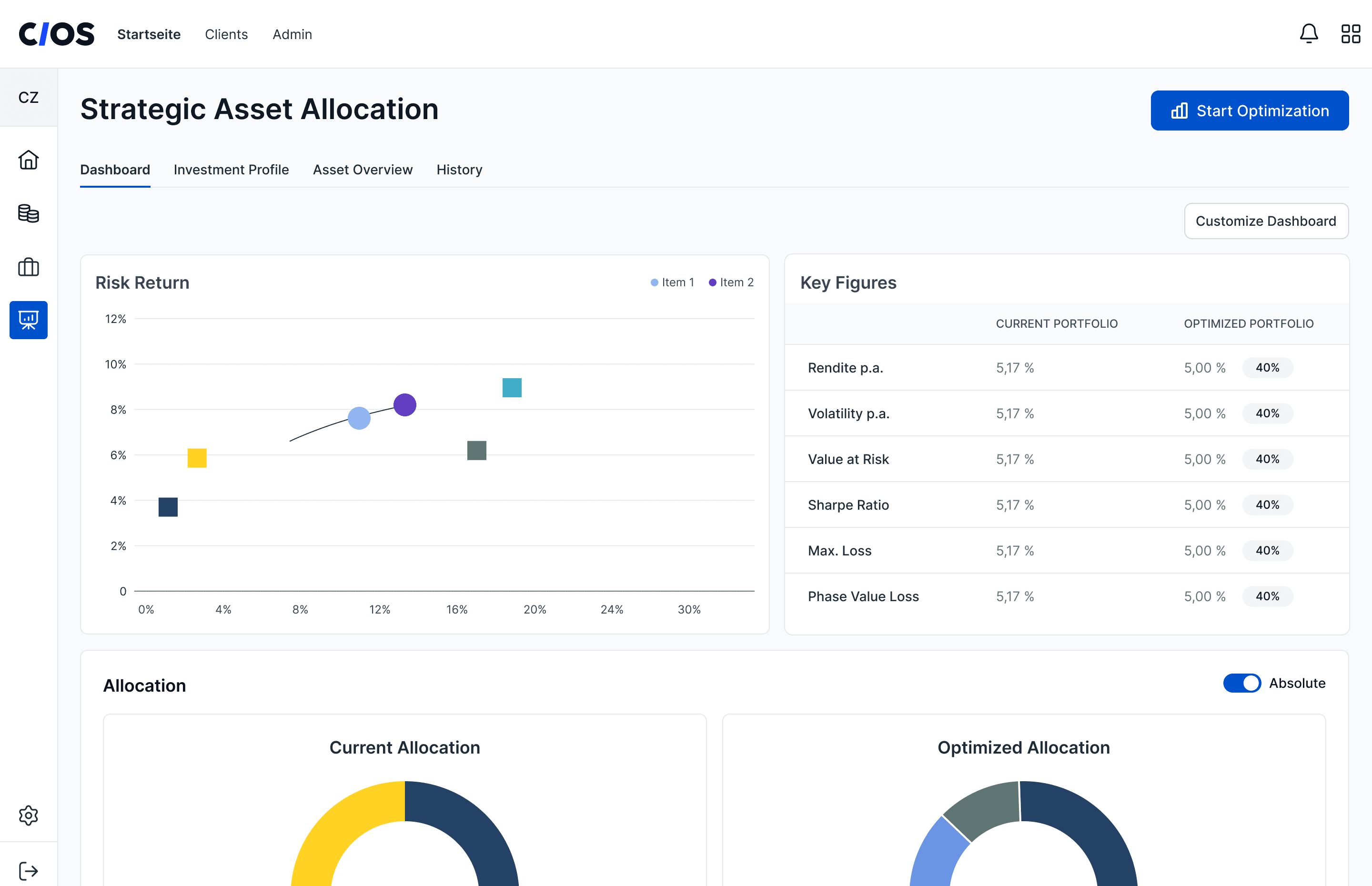

Advisor Reporting – Digital Tools for More Efficiency

Before-and-after comparisons of portfolios.

Consolidated client overviews.

In-depth insights into client portfolios for cross-selling potentials.

Management Reporting – Making Informed Decisions

Analysis of portfolio and client structure.

Status reports on regulatory compliance.

Performance evaluations for asset managers and advisors.

Start with fincite • cios

With fincite • cios, you can extend existing systems without having to replace them. The rapid implementation and flexible scalability ensure that you can optimize your processes and delight your clients. Contact us for a product demo and learn more about how fincite • cios can revolutionize your investment reporting or try it completely free for 14 days without providing your credit card!