Investment Reporting: Efficiency and Transparency for Your Finances

Rocio de Kment

20 Feb 2024

Why Good Investment Reporting Matters

Good reporting creates transparency. It helps you better understand your clients, increases the security of all investments, and opens up new sales opportunities.

By automating processes and leveraging cloud services, you can also achieve significant cost advantages. Technological solutions simplify compliance with regulations and generate genuine competitive advantages.

Benefits of Modern Investment Reporting

Clients benefit from clear, user-friendly visuals and real-time access to their portfolios.

As an advisor, you can determine the next best action for your clients and significantly increase your assets under management (AuM).

The investment office gains an overview of all actual portfolios.

Compliance officers can monitor investment restrictions.

The private banking sector uncovers new insights into net new assets and client churn.

Investment Reporting: Definition and Target Groups

Investment reporting varies significantly depending on the target group. Here’s an overview:

Client Reporting – Added Value through Transparency

Client reporting is a valued service among bank customers because it helps them keep track of their financial situation. Often, it is the only touchpoint outside the bank, fostering consistent interaction between you and your clients. Key elements of client reporting include:

Portfolio values and allocations

Stock and sector analysis

Transaction summaries and details

Accumulated revenues

Risk and performance metrics

Scenario simulations

Advisor Reporting – Actionable Recommendations for Success

Efficient advisor reporting helps you focus on the right areas. At a glance, you can see:

Which clients need portfolio adjustments.

Upselling opportunities.

Where you can prevent client churn.

Management Reporting – Lead Your Team More Effectively

Management reporting focuses on optimizing internal processes and distributing risk culture across business units. A detailed management report answers questions like:

How can the advisor team work more efficiently?

Who are the most profitable clients?

How can risks be identified early?

Which clients need support?

Technical Functions of Investment Reporting

Two main types of reporting are:

Event-Driven Reporting

This type evaluates data triggered by specific events, such as reaching predefined thresholds or performance deviations.

Time-Driven Reporting

This function displays key metrics over time, comparing them with previous years or highlighting percentage changes.

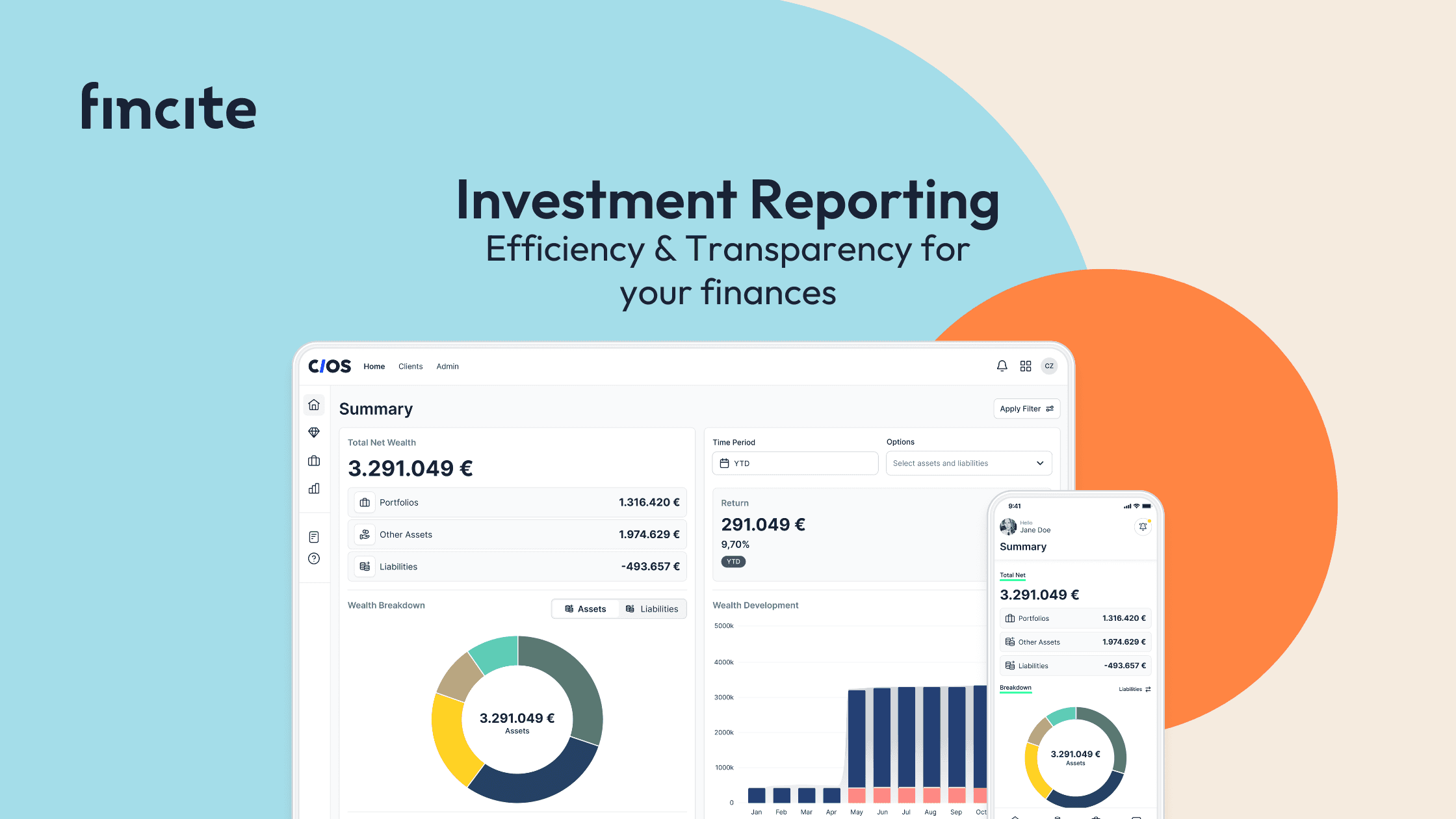

Fincite • cios – Your Solution for 360-Degree Investment Reporting

With the modular fincite • cios software from Fincite, you can create a unified data foundation that links client data with market data, algorithms, and custom rules.

Benefits for Your Client Reporting

360-degree view with real-time information on client assets.

Clarity on risk diversification relative to risk profiles.

Transparent overview of costs and fees.

Advisor Reporting – Digital Tools for Greater Efficiency

Before-and-after portfolio comparisons.

Consolidated client overviews.

Deeper insights into client portfolios for cross-selling opportunities.

Management Reporting – Make Informed Decisions

Analyze portfolio and client structures.

Status reports on regulatory compliance.

Performance evaluations for asset managers and advisors.

Get Started with fincite • cios

With CIOS, you can enhance existing systems without replacing them. Its quick implementation and scalable flexibility allow you to optimize processes and impress your clients. Contact us for a product demo to see how fincite • cios can revolutionize your investment reporting or try it 14 days for free.