Personalized Wealth Management: From Trend to Must-Have

Pascal Zirkler / February 20, 2023

Large companies like Netflix, Amazon, and others have recognized the added value of personalized offers and use them effectively to keep their customers loyal to the company. Personalization of investment offers is also becoming increasingly popular with wealth management clients. However, the details of what a wealth management advisory tailored to personal needs look like, and how financial institutions can improve their customer loyalty through it, are revealed in the following.

Definition of Personalization

Personalization is the process of tailoring a product or service to the individual needs, preferences, and goals of a single customer. Information about the customer is used to create an offer that meets specific needs and requirements. In wealth management, personalized solutions are also becoming increasingly popular as clients are seeking customized investment solutions that reflect their personal values.

The significance of Personalization in Wealth Management

In contrast to major digital players such as Google and Netflix, who have already extensively leveraged the advantages of personalization, banks and wealth managers often offer their clients only "one-size-fits-all" solutions, meaning generic investment strategies that often do not connect with customer requirements. However, a tailored offering, based on individual interests and goals, would also generate tremendous interest in the wealth management industry.

In a recently published study, 70% of private investors stated that individual investment advice is the central factor in choosing their wealth manager. When advisors are able to present individual investment offers based on the specific needs, goals, and risk tolerances of their clients, they create a sense that their finances are being managed efficiently and meaningfully. This allows investors to focus on realizing their life goals ("lifetime moments") without worrying about their financial future. Financial institutions improve customer satisfaction (NPS) and lay an important foundation for building long-term customer relationships based on trust and understanding.

Outlook on the Future

Investment clients have learned in other areas of life that their individual needs are reflected in digital offerings and they expect the same from their bank. Technological advancements will help make personalized wealth management accessible to a broader range of customers. Banks and wealth managers must understand the specific needs of each client to offer tailored wealth management solutions. BCA, one of the largest and most well-known broker pool companies in Germany, has recognized the added value of personalization and successfully implemented it.

Roman Schwarze, CDO, BCA AG. - Testimonial Video

Individual Investment Strategies - The focus lies on the client's needs

An individual investment strategy is an important component of successful wealth management. Personal preferences and restrictions of the client are taken into account in order to develop an investment strategy that is aligned with the client's needs.

The integration of alternative investments, such as real estate, commodities, and exotic investments like art, is an important part of this investment strategy.

Building wealth by aligning with a client's personal goals and needs

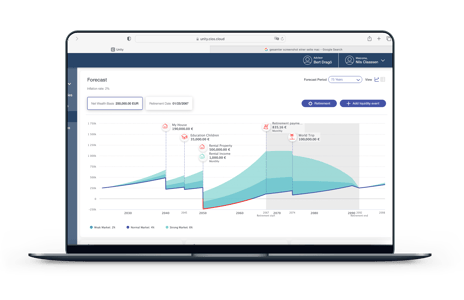

Wealth building should be aligned with the personal goals and needs of the client. The entire lifecycle of the client is taken into account, and potential gifts, inheritances, capital commitments, and business sales are considered early on. In this way, the wealth can be adapted to the client's real-life situation.

Increasing your client's satisfaction

An individual investment strategy leads to better communication between the client and the wealth manager, and therefore, to improved customer retention. The more detailed knowledge advisors gather about their clients, the less likely their clients are to switch to another bank.

More efficient Wealth Management

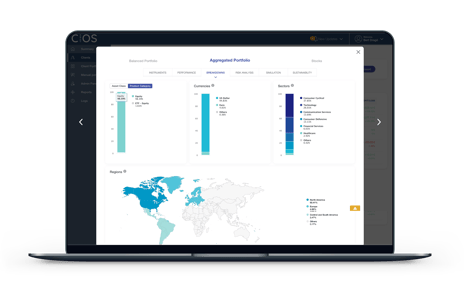

The development of individualized investment strategies is an important component for modern wealth management. However, it also means a higher effort due to more portfolios, all of which must be monitored in accordance with the client's and bank's restrictions. With modern investment software, a modular product universe can be efficiently and flexibly managed.

Adapting current Products and Services

It is clear that existing investment offerings must be adapted to enable a high level of personalization. Especially in the area of sustainable investing, which should consider ESG factors, particularly value-adding investment products can be offered. If individual securities are present in the client portfolio that do not contribute to these values, modern software tools can quickly identify these companies and replace them with other securities that are listed in the bank's investment universe in accordance with the client's specifications. But how can such a consulting concept be developed with a broad product offering and an IT landscape that has grown over the years? One option is asset management as a service, for example, through a subscription to various portfolios.

Integrating Technology and Automation

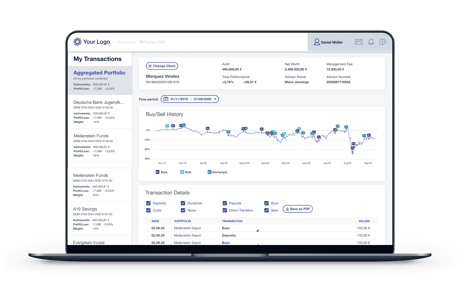

Advisor software that enables personalization at scale - as in the case of ANB Amro - is the decisive factor here. Real personalization can only be achieved by considering all restrictions (both customer and bank-side), automatic rebalancing, and the integration of external and internal data points. Existing technological infrastructure may not yet allow for personalization. Process optimization and automation can help enable more personalization by allowing advisors to spend time gathering information instead of managing it. AI-based systems such as voice recognition or assistance with administrative tasks can also support this. An in-depth analysis of AI in wealth management can be found here.

Training and Sensitization of the Customer Advisory Team

A paradigm and cultural shift is necessary for advisors. Existing workflows may need to be adjusted, requiring an adaptation of the work reality. However, a modern set-up for advisors can simplify administrative tasks and make work more enjoyable.

Cost-Benefit Analysis of Investing in Personalization

An investment in personalization is relevant to stay competitive, but the requirements are high. The status quo may be sufficient for the existing customer base, but not for future generations. The so-called Gen Z earns more, saves more, invests earlier, and with higher amounts than previous generations. For example, a full 31% of Gen Z began investing before the age of 21, compared to only 9% of Baby Boomers. In three out of four cases, the new investors chose an online or neo-broker (such as Trade Republic or Flatex). Factors such as easy account opening, intuitive usability and overview - especially on the smartphone - play just as important a role in the selection of the provider as high-quality charts, easy instrument search function and fast order execution. Generation Z has little trust in traditional bank advisors, so financial institutions should invest more in self-service functions and models to counter this.

An investment in personalization is relevant to stay competitive, but the requirements are high. The status quo may be sufficient for the existing customer base, but not for future generations. The so-called Gen Z earns more, saves more, invests earlier, and with higher amounts than previous generations. For example, a full 31% of Gen Z began investing before the age of 21, compared to only 9% of Baby Boomers. In three out of four cases, the new investors chose an online or neo-broker (such as Trade Republic or Flatex). Factors such as easy account opening, intuitive usability and overview - especially on the smartphone - play just as important a role in the selection of the provider as high-quality charts, easy instrument search function and fast order execution. Generation Z has little trust in traditional bank advisors, so financial institutions should invest more in self-service functions and models to counter this.

Outlook and Conclusion

In a rapidly changing world, personalization is an important factor for standing out and being successful in wealth management. Furthermore, customers expect their bank to provide individual and tailored support, as they have already experienced this in other areas of their lives. A holistic consideration of product and operational aspects, as well as the reality at the bank, is necessary to successfully implement personalization in wealth management. The requirements of advisors and customers must also be taken into account. Technological advances and digitization offer opportunities for the future to provide personalized support at the highest level.

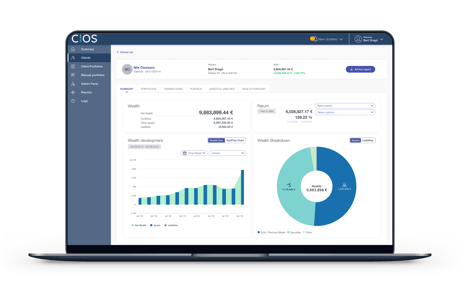

For the successful implementation of personalization in wealth management, we recommend partnering with Fincite. Fincite with Fincite.CIOS considers the requirements of advisors and upcoming customer needs. Close collaboration with Fincite enables the successful implementation of personalization in wealth management.

Let's work together to shape the future of wealth management and make personalization your competitive advantage.