Retail Investment Advice: These 3 Focal Points Lead to Success

Dennis Ritter

17 Feb 2025

The role of investment advisors in retail banking has fundamentally changed in recent years. The increasing complexity of financial markets, the flood of information, and growing customer expectations present retail investment advice with new challenges. A report from the perspective of a former customer advisor.

The challenges of modern retail investment advice

Before Dennis Ritter started as an Account Manager at Fincite, he worked for ten years as an advisor in retail banking. During this time, he realized how crucial a modern IT infrastructure and software are for investment advice. However, there are three central challenges:

1. Complexity of financial markets and customer expectations

Comprehensive knowledge of all asset classes is essential.

Customers increasingly compare offers online and expect personalized advice.

Regulatory requirements such as WpHG and MiFID necessitate standardized processes.

Missing standardized processes lead to errors that later need to be corrected – an enormous amount of time and cost.

2. High workload and lack of time

Time pressure complicates individual retail investment advice.

Sales potential often remains untapped.

High turnover of advisors complicates customer retention.

An efficient consulting process is essential to build long-term trust with customers.

3. Digitalization as the key to increasing efficiency

The solution to many of these challenges lies in digitalization. Modern software solutions enable:

Quick access to information for informed investment decisions.

Automated processes that reduce administrative tasks.

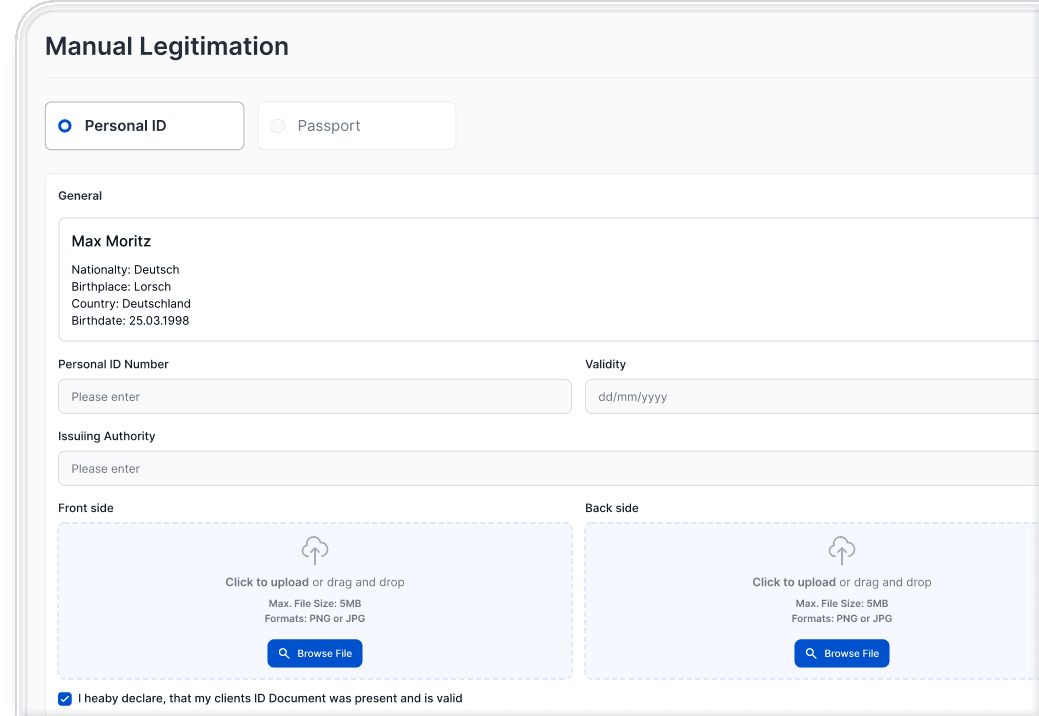

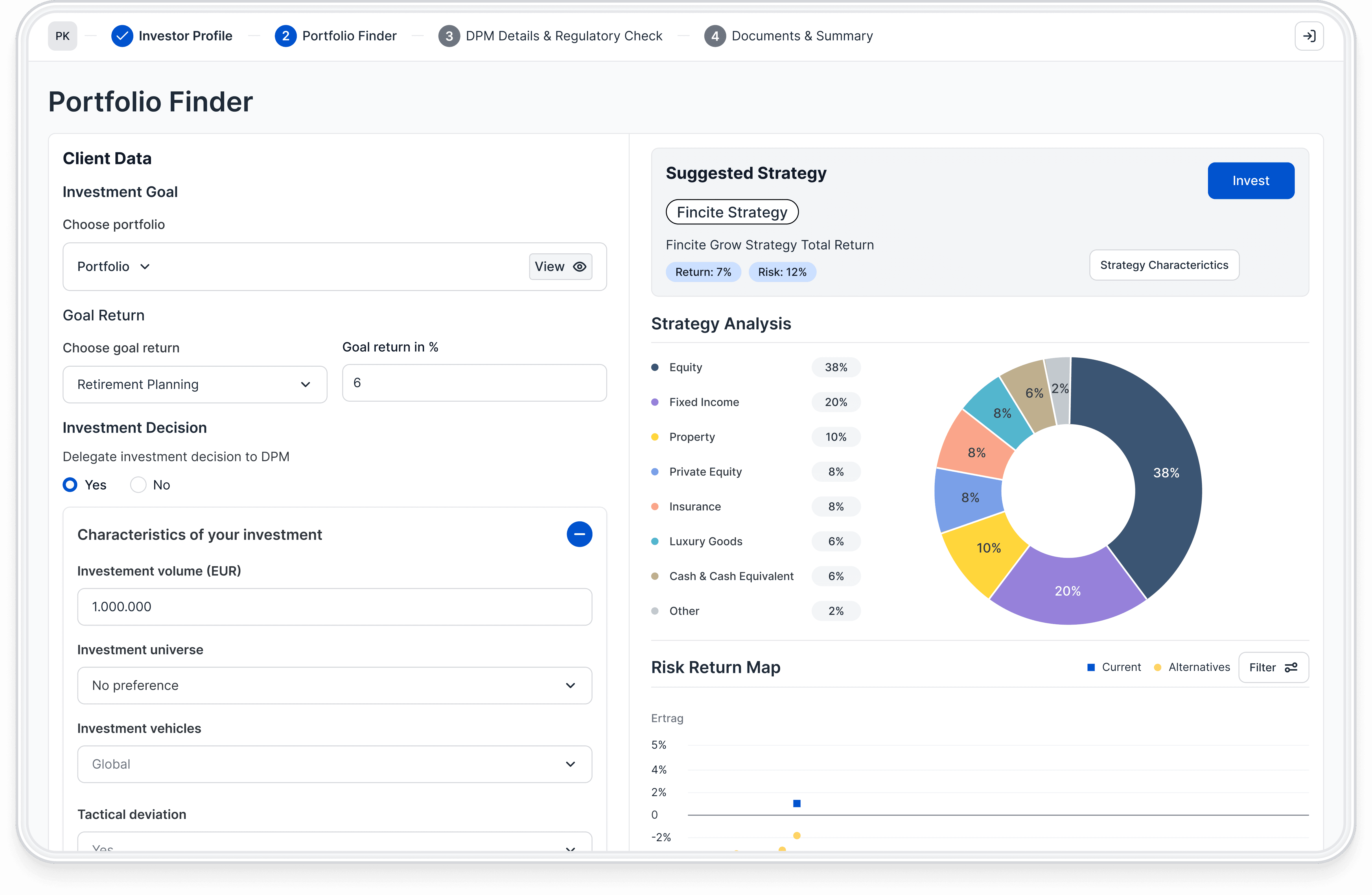

MiFID II-compliant risk profiling with intuitive user interfaces.

The three core elements of successful digitalization

1. Efficiency through optimized access to information

Thanks to specialized software, the tedious gathering of data from various sources is eliminated. Example:

Onboarding processes can be designed to be 60–80% faster.

Intuitive UX systems allow for seamless consulting.

Automated documentation reduces error rates.

2. Strengthening trust through holistic advice

Advisors should be able to advise across various asset classes.

Customers expect comprehensive financial planning – including for alternative investments like crypto or precious metals.

A well-thought-out strategy & planning can sustainably consolidate trust.

3. Individual investment reporting

Retail investment advice is strengthened by detailed analyses & reports:

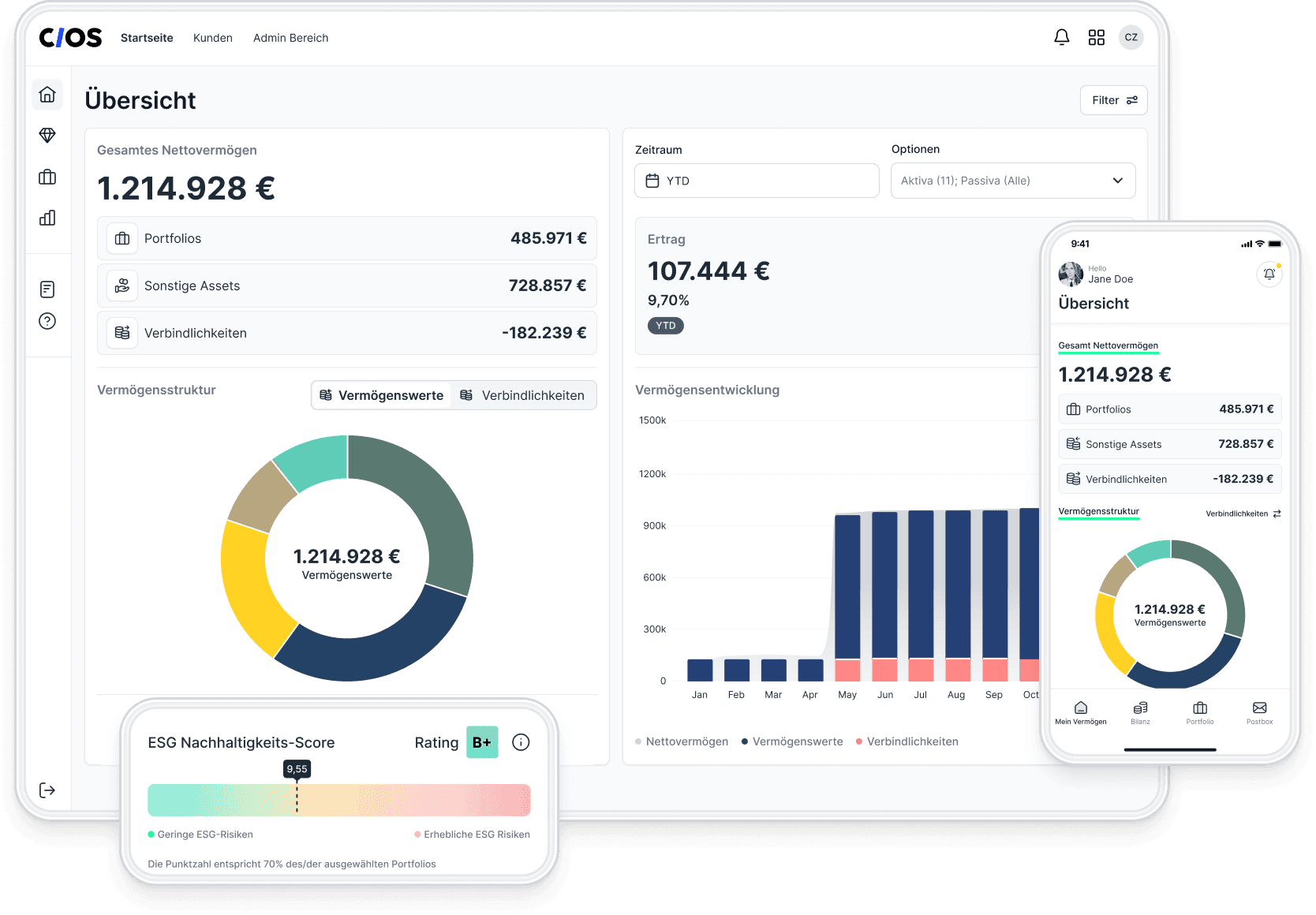

Real-time dashboards provide clear metrics for informed decisions.

Automatic portfolio comparisons facilitate advising.

Deep-dive analyses (e.g., Value at Risk) provide detailed insights.

Conclusion – The future of retail investment advice

Retail advisors face significant challenges: Increasing complexity, high customer expectations, regulatory requirements, and a shortage of skilled professionals require new strategies.

Increasing efficiency, digital advisory solutions, and modern software are the keys to success.

The right balance of people & technology creates sustainable customer loyalty.

Let's shape the future of retail banking together! Contact me or our team for a personal consultation.