Sustainable Investments (update 2020)

Christian Paulus / November 3, 2020

All you need to know about regulatory initiatives, implementation deadlines, and impacts for financial institutions

In our former blog post, we explained what ESG stands for and how important and beneficial it is to incorporate ESG factors into your investment screening processes. (Read the former blog post about ESG)

Today we will give you a 2020 update on this very crucial topic which will impact the future of the financial industry.

What is the Current State? More Clarity and Less Ambiguity

Currently, there are global efforts to regulate the financial market and standardize the approach towards defining and measuring sustainable investments. Within the European Union, the deadlines for ESG implementation for financial institutions are getting closer. The first ones announced deadlines are in April 2021. The regulations proposed by the commission will influence retail & private banks, asset managers, and target the entire value chain of advisory and investments.

Nevertheless, measuring and defining sustainable investments remain the biggest challenge since a standardized approach among European countries still needs to be established. At Fincite we believe in a co-existing scheme which includes regulatory "must do’s" and voluntary approaches. Our ultimate goal is, therefore, to provide financial market participants with smart solutions.

With this article, we are going to break down the most important points step by step and showcase an innovative software solution for your business.

The European Union’s Green Deal: Goals and Frameworks

In order to transform and improve the European economy, the EU Commission presented the European Green Deal in December 2019 (as a result of the renowned Paris Agreement in 2015).

One of the most important components of the Green Deal is the proposed “Climate Law�? embedding a legal commitment for the EU to achieve climate neutrality by 2050. The EU will bring forward a comprehensive plan to increase the EU 2030 climate target to at least 50%.

The main objective of the Green Deal and the climate target is to achieve the climate goal of staying below 1.5°C global warming.

In order to achieve these climate goals, every regulatory initiative from the European Green Deal will pursue to have a positive impact

on 6 formulated environmental goals:

1. Climate Change Mitigation

2. Climate Change Adaption

3. Sustainable Use & Protection of Water & Marine Resources

4. Transition to a Circular Economy

5. Pollution Prevention & Control

6. Protection & Restoration of Biodiversity & Ecosystems

Furthermore, Green Deal also draws attention to the following frameworks that will determine the green and sustainable investment:

1. EU taxonomy for sustainable activities

2. EU Green Bond Standard

3. EU climate benchmarks & benchmarks’ ESG disclosures

4. Sustainability- related disclosure in the financial services

5. Integration of ESG into investment advice & portfolio management

The EU Taxonomy framework is specifically important as it will create a unified classification system to define environmentally sustainable economic activities related to the environmental goals mentioned above. It aims at introducing a list of technical screening criteria that will define the degree of sustainability of a company and thus, it’s issued financial instruments. It is designed for use in disclosures as well as in standards, labels, sustainability benchmarks, and other areas.

ESG Regulatory Requirements Along the Whole Investment Value Chain

The ESG Regulatory Requirements have a direct impact on the investment value chain comprising

On-Boarding and Advisory, Portfolio Management, and Analytics & Reporting.

A) For On-Boarding & Advisory, ESG Regulations will be integrated within these processes:

�? Customer’s ESG preference & consideration in the KYC-process

�? Description of ESG relevant risks

�? Transparency over ESG products

�? Description of reference values & benchmark

B) For Portfolio Management the ESG initiatives mean:

�? Applying standardized ESG scores into portfolio analysis and optimization

�? Applying customer’s ESG preference in the investment proposal

�? Compliance with EU standards

C) For Analytics & Reporting it will include:

�? Providing periodic reporting for ESG labeled products

�? Description of ESG reference values & ESG benchmarks

�? Statement of compliance with EU taxonomy and related regulations

Regulatory Timeline for Sustainable Finance Considerations

According to the information shared by the Commission, deadlines for the implementation for banks, insurers, and asset managers to be ESG-compliant are as follows:

1. January 2022 → EU taxonomy for sustainable activities for environmental goals 1+2

2. January 2023 → EU taxonomy for sustainable activities for environmental goals 3-6

3. April 2021 & January 2023 → Part I and Part II of Sustainability-related Disclosure

4. January 2022 & January 2023 → Part I and Part II EU climate benchmarks & benchmarks’ ESG disclosures

Despite the given timelines, experiences and observations show that these alignments will likely delay and need to be enhanced in coordination with market stakeholders. The EU-Commission Taxonomy, therefore, will likely not fully cover the required definitions for sustainable investment. Due to possible delays and long decision-making processes, there will be high uncertainty and a loss of implementation time for financial institutions.

Advantages of Voluntary ESG Taxonomy Approaches

In addition to the official EU regulations it is advisable to start with an individual ESG approach which will bring you:

- a competitive advantage,

- brand your institutions as a first mover and shape your USP,

- extent your client base by winning ESG seeking clients (currently an underserved client base),

- more flexibility by quick adaption to ESG taxonomy standards as Fincite can easily adapt the ESG algorithms in the backend

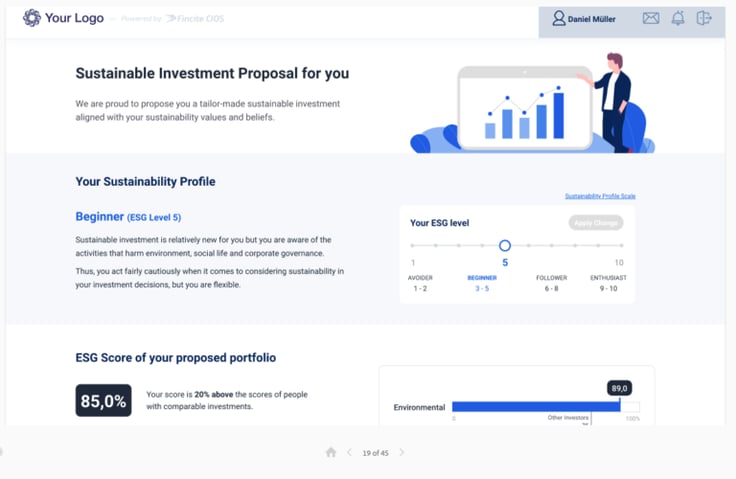

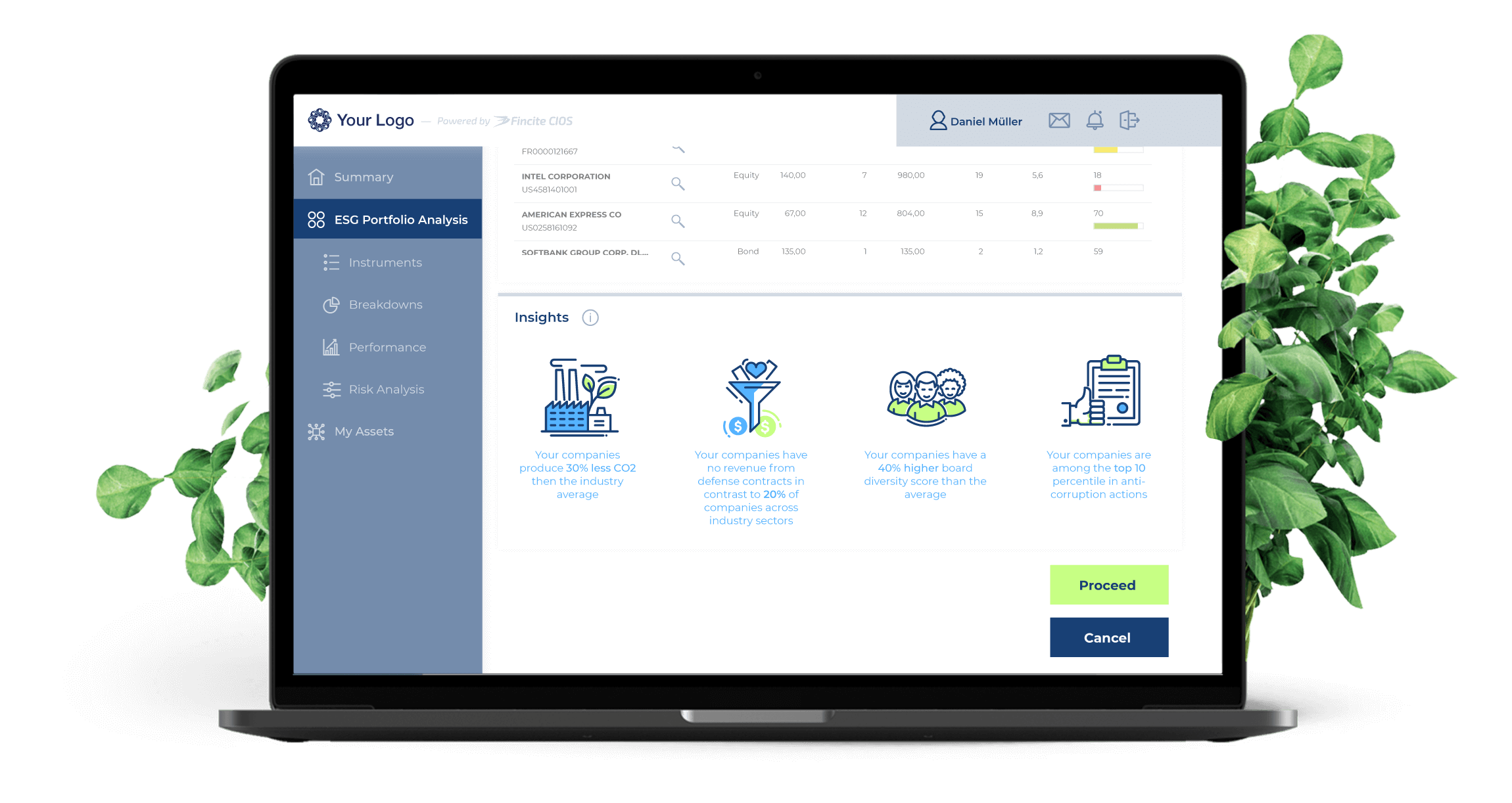

Fincite ESG Solution from Customer On-Boarding to Portfolio Optimization

With our software engines, we can implement regulatory-driven ESG requirements into your existing business and IT processes. Fincite.CIOS covers an ESG compliant On-Boarding Questionnaire, Pre and posts contractual clarifications as well as Suitability Test Clarifications. Thanks to our ESG Taxonomy, KPIs, Portfolio Analysis & Optimization, and ESG Portfolio Proposal we support your investment advice to be ESG compliant.

Learn more about ESG Regulations and Standards and download the ESG presentation!(for free)