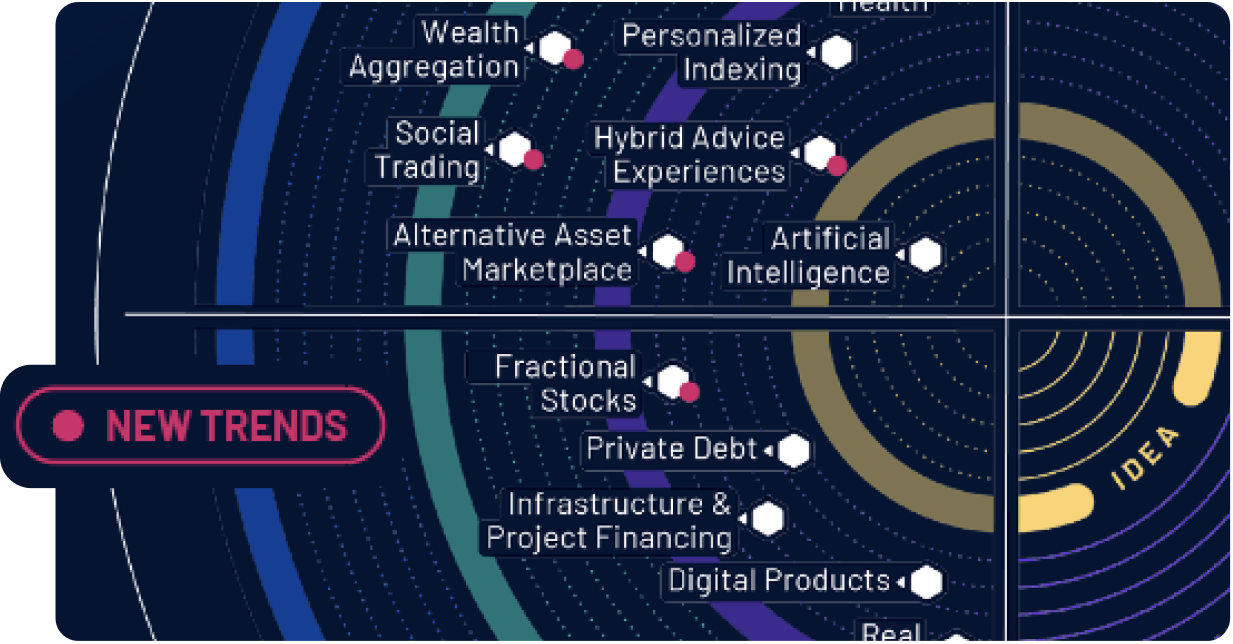

22 Trends

Together with our experts, we have analysed 22 trends in detail.

Our Software Solutions for your Customer Onboarding as Self Execution, Advisor Guided or Hybrid!

Whether 100% digital or hybrid with personal advice, our software adapts to your operating model in a modular way.

From SAA Construction, Advisor Software to Portfolio Management. Our software digitizes your process E2E.

Transaction Ordering. Contact us for more information.

From asset aggregation to portfolio analysis with CIOS.Reporting you get all your clients' asset data - prepared in intuitive dashboards.

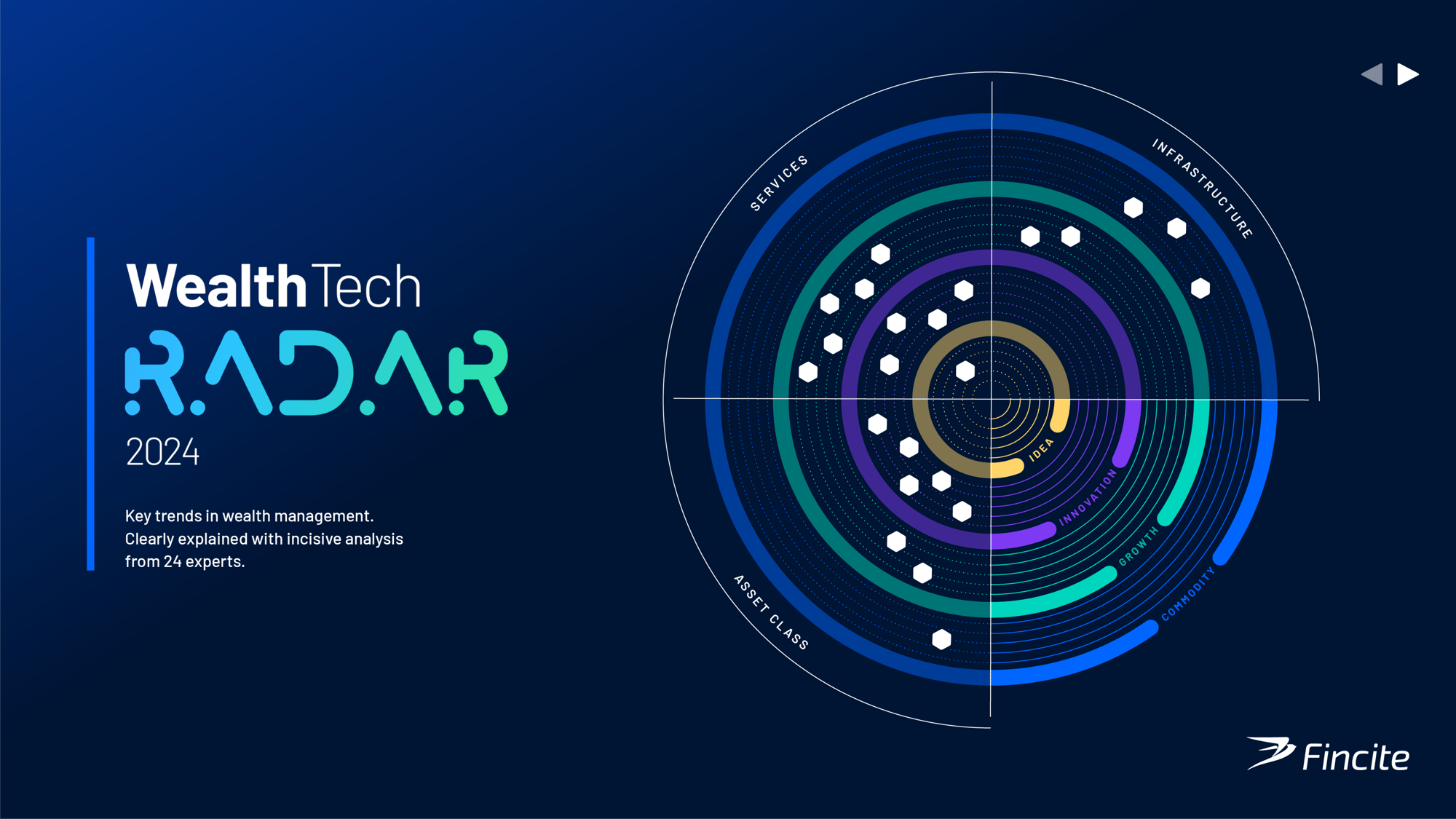

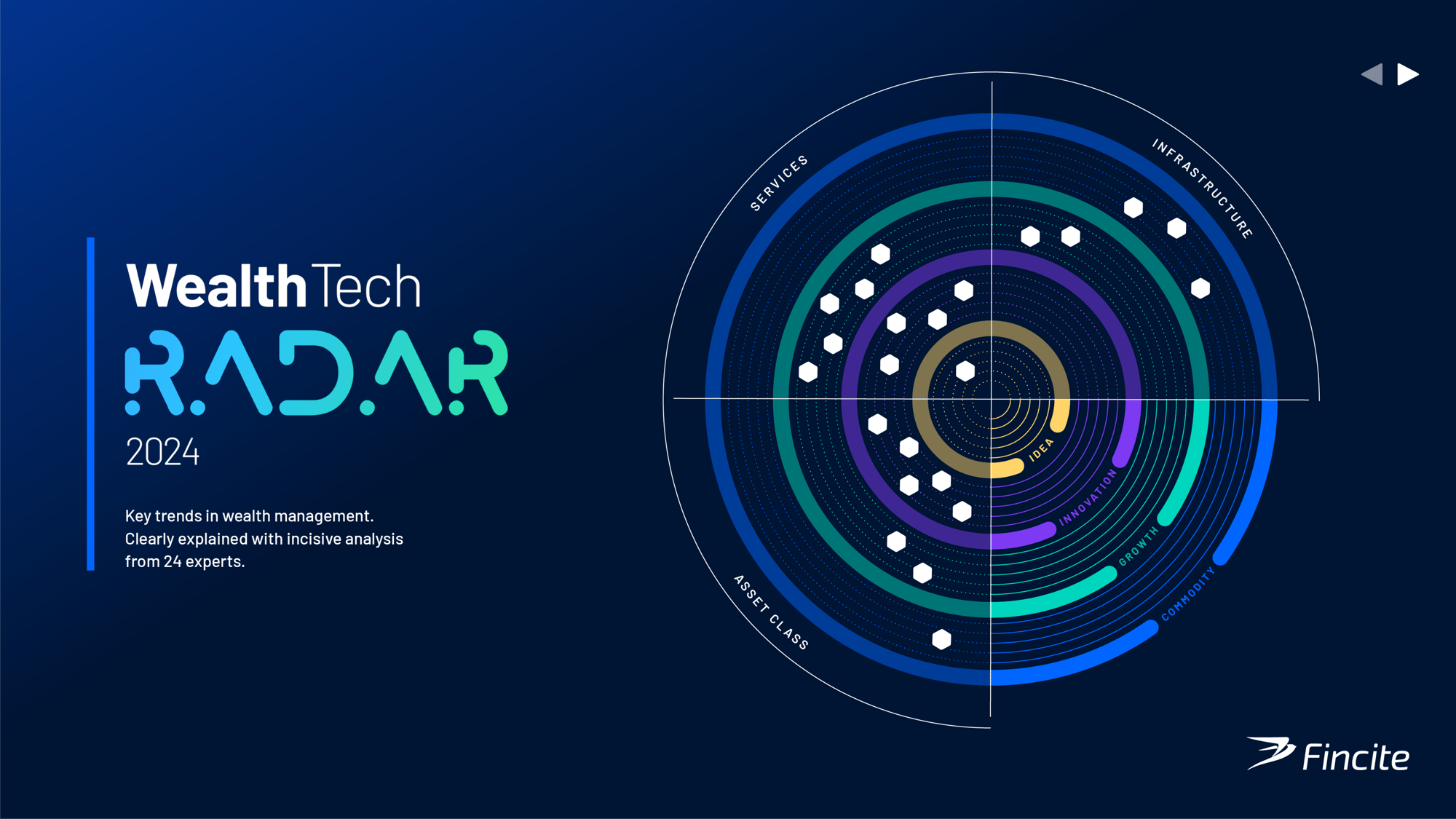

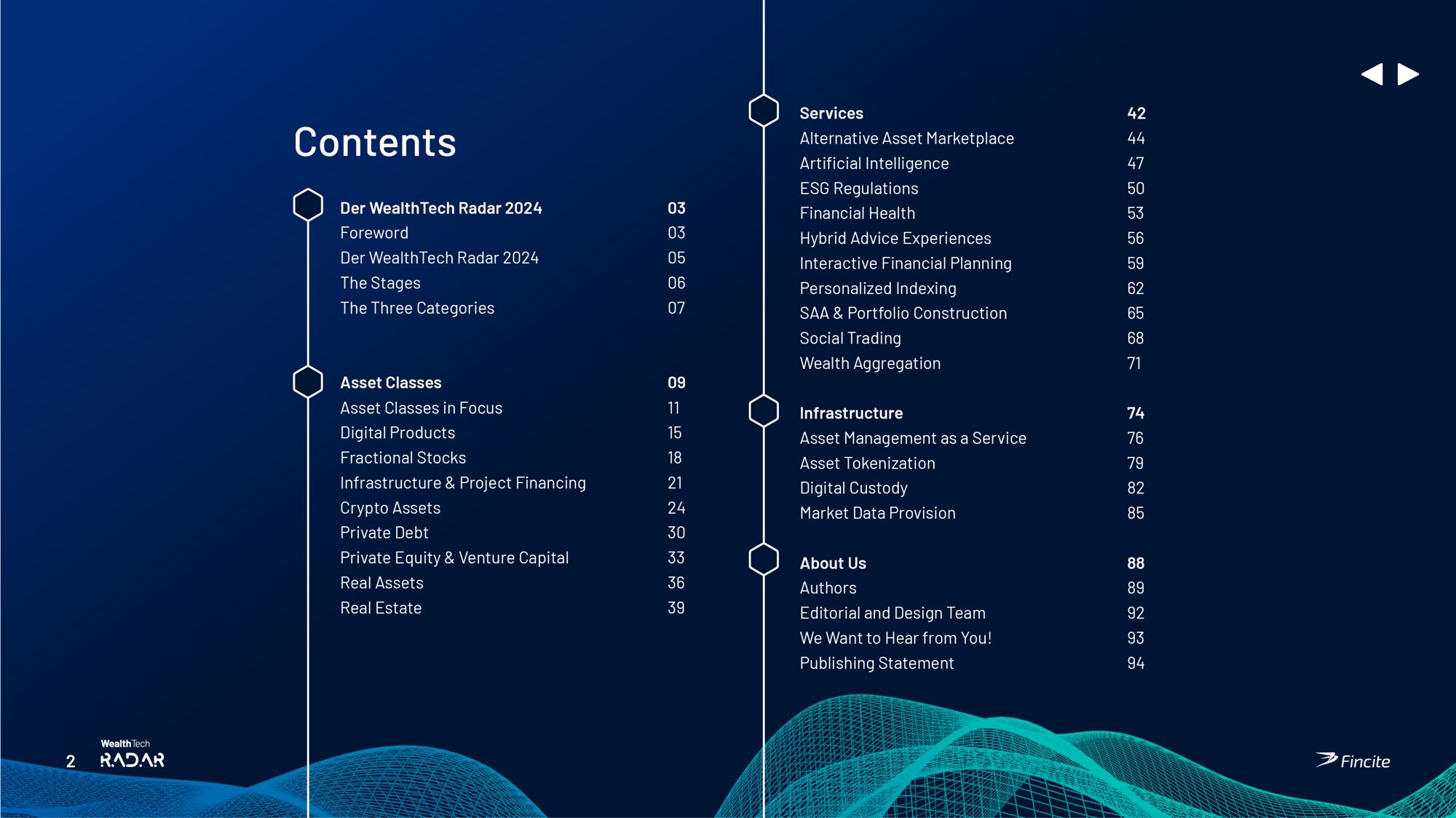

The WealthTech Radar 2024 provides you with in-depth insights into the major future topics of our industry in a clear and coherent assessment by 24 experts.

Together with our experts, we have analysed 22 trends in detail.

All about asset classes, regulation, AI and further tech trends.

From the industry for the industry!

Sohail Raja

Nico Baum

Alireza Siadat

Jan Voss

Robin Nehring

Ralf Oetting

Sonia Zugel

Alexander Sperlich

Marco di Sazio

Christian Crain

Reinhard Pfingsten

François Botha

Olya Klueppel

Ulli Spankowski

Thuwagaran Nithiananthan

Juan Colón

Malte Häusler

Simon Seiter

Karsten Kehl

Marius Briem

Christoph Püllen

Martin Schaffranski

Oliver Bussmann

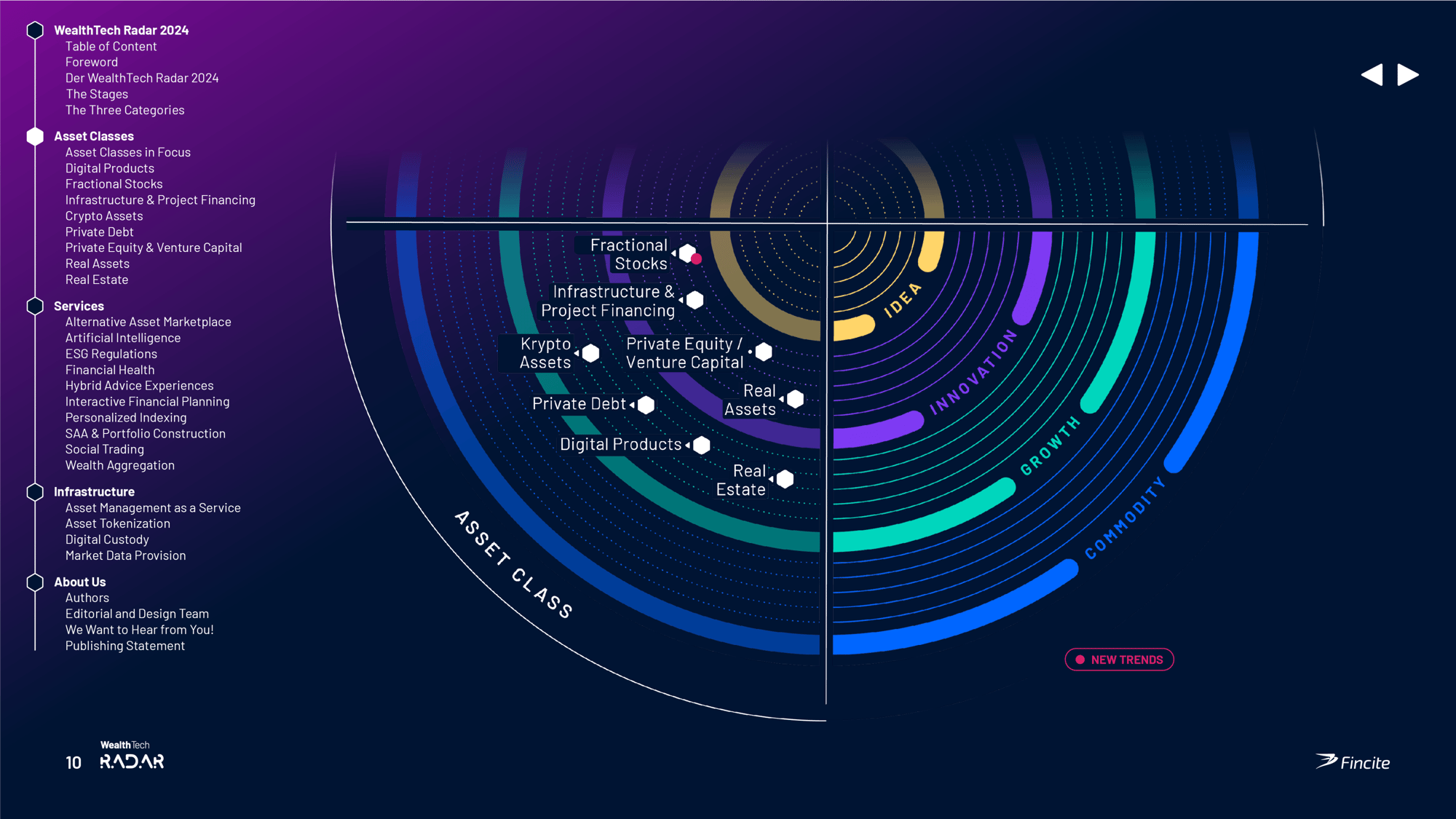

Which products will find their way into the strategic asset allocation in wealth management? Which asset class offers the highest potential?

.png)

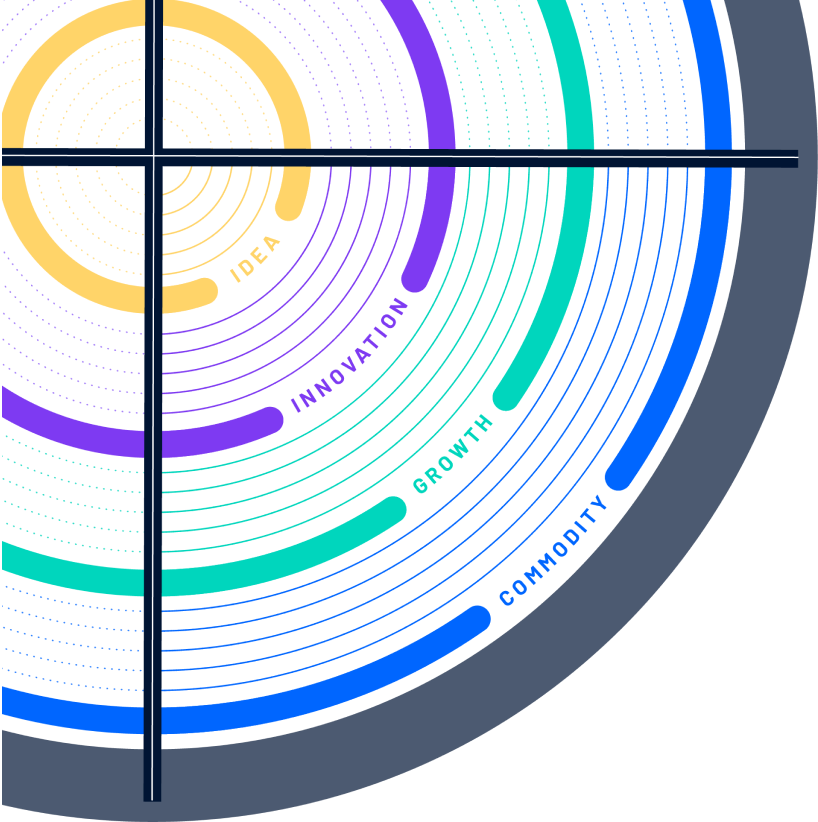

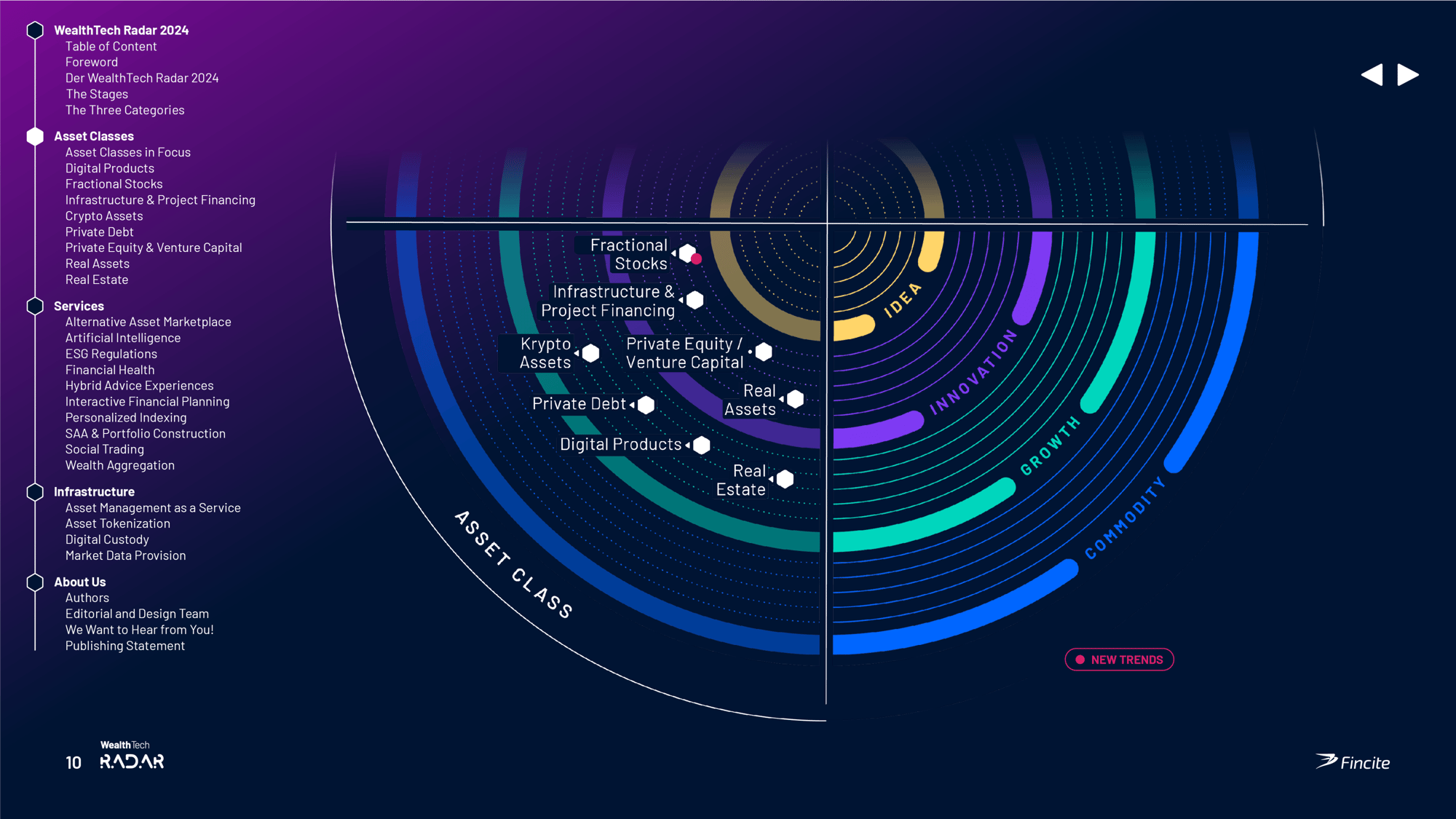

After months of research, the editorial team analysed each trend in detail and, together with the co-authors, categorised them into the following four maturity levels:

In an era where the synergy of AI and digital solutions is reshaping wealth management, seizing opportunities in digital assets will become essential in reaching underserved and emerging markets through innovative and custom-tailored investment strategies.

Private debt is poised to capture investor attention due to a favourable risk/return profile and attractive absolute returns versus other asset classes such as equities or liquid credit.”

Enable access to the capital market for an attractive, young target audience with fractional stocks.

The CSR Directive went into effect in January 2024, with 50,000 companies needing to report by 2026.

The best of both worlds: hybrid financial advice is a game changer.

Humans and artificial intelligence (AI) complement each other perfectly to deliver better results through combined effort. AI will not fully take over our jobs, but the employees who use AI most likely will.

Using accurate, current, and well-organized data has the potential to reshape the whole value chain.

Regulation will become the driver for asset tokenization in 2024.

Digital custody – The key element in the growth market for crypto and digital assets.

.png?height=2000&name=Autoren_Januar2024_nochmal%20Duallight_mit%20etwas%20staerkeren%20effekt_linkeninposts_Alexander%20Sperlich%20(1).png)

For future success, data providers need solutions that offer additional value. Simply providing data will no longer be enough.