Boost Sales: Our software helps you to efficiently place and utilize your sustainable products.

ESG Investment Software:

Empowering sustainable investments

Sustainable Investments are nowadays both regulatory and market-driven. The EU Commission launched the European Green Deal, as a result of the Paris Agreement in December 2019, which aims to make Europe climate neutral by 2050 and keeping global warming below 1.5°C.

Apart from the regulatory measures, another important driving force is the market demand: 83% of German retail customers feel that environmental and climate protection is among the greatest challenges of our time.

While 52% of retail customers expect from banks or insurers that they offer sustainable financial products, only 5% of those “own“ a sustainable, financial product!

The Fincite ESG investment software, empowers financial institutions to offer their clients a comprehensive ESG investment service – from sustainable Onboarding & Advisory, Green Portfolio Management to Sustainable Reporting.

Benefits of Our ESG Investment Solution

Save costs & time, focus on what’s important: your customer!

Increase Transparency over financial products for your customers.

Be Regulatory-compliant: automatically updated through our SaaS approach.

The Core Functionalities of Our ESG Software

Onboarding

ESG Reporting

Portfolio Analyse

Optimization and Proposal

Onboarding

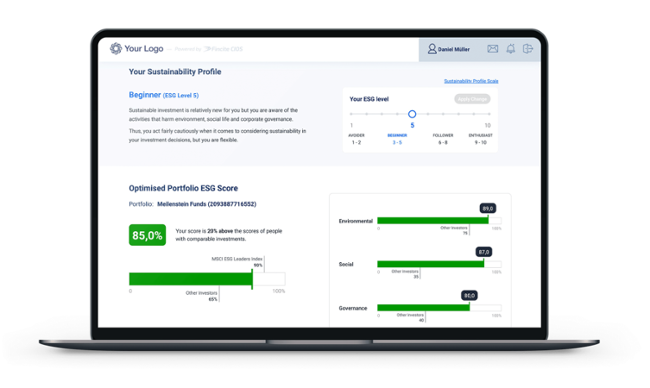

- Extract customer’s sustainable investment profile.

- Enable your customers to exclude certain industries from the investment universe and select the European Commission environmental goals that the customer feels associated with.

- Classify customer into different categories characterized by his/her willingness to invest in sustainability (from e.g.,” ESG enthusiast” or “avoider”).

ESG Reporting

- Create a regular customer reporting that reflects the most relevant ESG impacts of your customer portfolios.

- Provide modular adaptable reports according to the bank’s internal investment guidelines.

- Create suitability tests and other regulatory required contractual obligations.

Portfolio Analysis

- Analyze your existing customer’s portfolios based on ESG KPIs – both on portfolio and on single instrument level.

- See the current ESG performance of your customer portfolios and display further ESG relevant insights (e.g., current CO2 footprint of the portfolio).

Portfolio Optimization and Investment Proposal

- Optimize existing portfolios based on the triad optimization components: ESG

- Scores & KPIs, Return and, Risk Return. Show and analyze the optimized portfolios with state–of–the–art graphics.

- Derive an ESG–compliant portfolio of existing customer’s portfolios or build an ESG–compliant portfolio for new customers from scratch.

- Utilize ESG–compliant existing model portfolios or build your own ESG portfolio.

Our Expertise in The Integration of ESG Data Provider

The successful integration of ESG scores depends highly on the data provider quality. Fincite delivers you the following benefits:

Profit from our broad market knowledge and identify the fitting data provider for your financial institution.

Experience transparent data provider onboarding process.

Access to real-time ESG data by connecting our engine through an API.

- Be ready for the regulatory implementation as soon as possible and use the head start for getting familiar with the new ESG standards against your competitors.

- Be the first mover offering sustainable investment portfolio management and propose your sustainability USP.

- Extent your client base by winning ESG seeking clients who currently are an underserved client base.

Feedback from our clients:

With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.

The collaboration with Fincite will enables us to make our investment research services directly available to our partners, especially from the perspective of Bank für Vermögen AG, in client advisory services, but also in individual portfolio construction.

Evergreen is aiming for technological leadership in digital financial planning and investing. Fincite’s CIOS is paving the way from our state- of-the-art asset management to a great customer experience.

Together with Fincite, we have created a new-generation financial analysis tool. Their innovative thinking combined with their strong focus on financial mathematics led to an impressively efficient tool for our clients.