Create customizable client reports and regulatory-compliant statements within few clicks (e.g. risk & return, breakdown by asset class).

Wealth Insights. Tailored Reports. Unmatched Analysis!

Unlock the Power of Data: Gain precise wealth insights with overall wealth aggregation, customized reports and advanced analysis.

Supercharge your growth: Boost AuM by 20%, attract more clients, and offer personalized, data-driven wealth advice with CIOS Reporting. Incl. market data from Morningstar.

starting 199 € / month

Why CIOS.Reporting?

Enhance transparency and empower your clients with user-friendly interface for easy-to-understand insights.

Fast & cost-efficient rollout. Integration into your IT landscape incl. Morningstar market data.

Frontend with access for advisors and clients

Advisors

CIOS.Reporting enables advisors to gain a full overview of the client's portfolio and financial situation, including the creation and distribution of reports - directly from one application.

Clients

Clients get access to their current portfolio and financial data with easy-to-understand charts. They stay well informed at all times via the inbox.

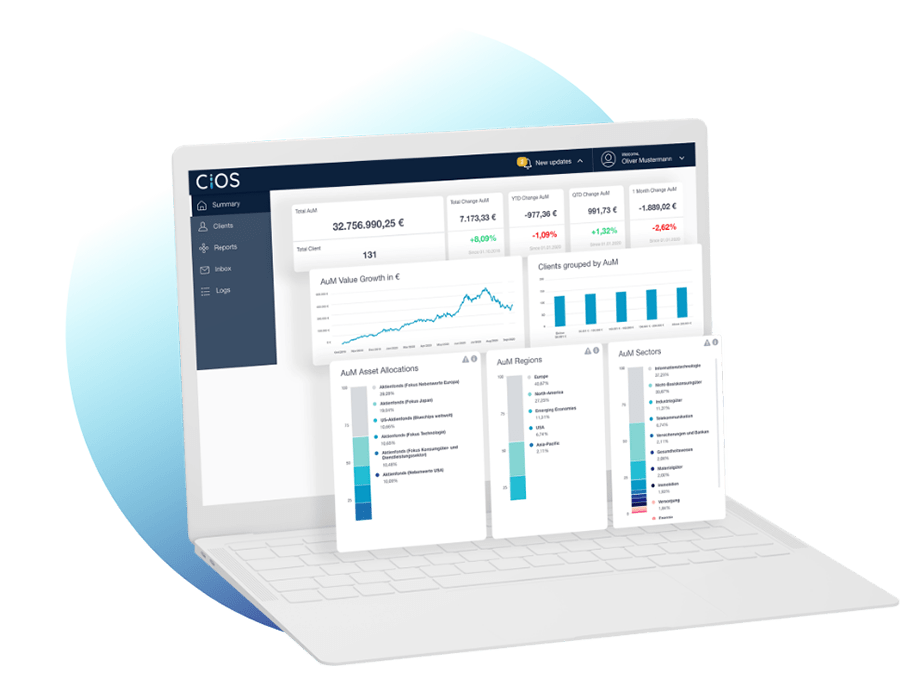

Customer-Centered Interface: analyze overall wealth with ease through dynamic dashboards

CIOS.Reporting offers clients and advisors a powerful platform for gaining a holistic overview of all invested assets and conducting in-depth portfolio analysis. With the ability to add alternative assets and include income streams from these assets, advisors are equipped to provide more meaningful advice on the overall financial situation.

Our software enables advisors to effortlessly create snapshots of their clients' financial situation with just one click, significantly optimizing the efficiency of their personalized investment advice. By leveraging these new insights, advisors can generate more engaging conversation starters tailored to each client's individual circumstances, resulting in a higher conversion rate.

CIOS.Reporting empowers advisors to deliver comprehensive and tailored wealth management services that drive better outcomes for their clients.

Key Features

Wealth aggregation

Portfolio's and alternative assets with income streams

In-depth analysis

by asset class, regions currencies and sectors incl. detailed view.

Portfolio development

Presentation of absolute and relative portfolio development and (own) benchmarks.

Sustainability analysis

Analysis of portfolois and funds according to ESG criteria.

Investment

Simulation of future performance and historical stress tests.

Risk analysis

Value at Risk, Maximum Drawdown, Expected Shortfall, Volatility, Stress Test, correlation matrix & more.

Dynamic calculation

Performance (time and monetary weighted return, annual performance). performance indicators Sharpe Ratio, Sortiono Ratio, etc.

CIOS References & Track Record

0

Customers

0

Advisors

0

Portfolios

0 %

Cost savings compared to individual development

0 Million

Orders & Transactions

Feedback from our clients:

With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.

The collaboration with Fincite will enables us to make our investment research services directly available to our partners, especially from the perspective of Bank für Vermögen AG, in client advisory services, but also in individual portfolio construction.

Evergreen is aiming for technological leadership in digital financial planning and investing. Fincite’s CIOS is paving the way from our state- of-the-art asset management to a great customer experience.

Together with Fincite, we have created a new-generation financial analysis tool. Their innovative thinking combined with their strong focus on financial mathematics led to an impressively efficient tool for our clients.

Your WealthTech Experts

Our Promise:

Get the Case Study directly into your email box.

Discuss your digitization project with our experts. Whether it's customer onboarding, digital or hybrid consultation, ESG or investment reporting.

Personal demo on request.

-1.png?width=972&height=433&name=WealthTech%20Experts%20Contact%20Form%20(1)-1.png)