Create individual Investment Reportings

Christian Paulus / November 1, 2019

Analytical dashboard with real-time information on all investments – for your clients, relationship, and investment managers! An effective reporting creates transparency. It helps better understand your customers, increases the reliability of all investments and can also generate sales impulses.

Automating manual processes and using cloud services can also bring significant cost benefits. When it comes to the manageability of regulation and compliance, technological reporting solutions can generate real competitive advantages.

With our software, your customers get a better picture of their own portfolio with a user-friendly presentation and thanks to real-time access.

Within the bank, several departments benefit from comprehensive reporting software:

- Advisors can use it to derive the next best action for the customer and increase the AuM

- The Investment Office receives an overview of all the security accounts

- Compliance Officers gain insights into investment restriction violations

- The Private Banking division gathers new insights into the

development of the net new assets and churn

Investment reporting – definition and delimitation

Generally, three different stakeholder groups can be defined for investment reporting:

Clients

Advisors (or relationship managers)

Management (including supervision)

Reporting Definition by Target Group

Client Reporting – from MiFID2 to real client added value

Client reporting is an important service and appreciated by most banking clients as it helps them to keep track of their whole financial situation. Sometimes it is even the only out-of-bank touchpoint that provides consistent interaction between the client and the bank. It mostly covers the following sets of criteria:

- Portfolio values

- Portfolio allocations

- Stock/security and sector analysis

- Transaction summary and details

- Accrued income

- Risk and performance figures

- Scenario simulations

Reporting for Advisors and Relationship-Managers offer guidance and the next best action for your clients!

In addition to the client’s overview and dashboard, a great reporting helps to focus the attention to where it’s needed.

A user-friendly advisor reporting displays:

- which customers need to adopt the portfolios

- upselling potential

- prevention of churn where applicable

Management Reporting how to understand and manage your organization better

There are specific regulations financial institutions need to follow when it comes to reporting. In order to stay up-to-date with these regulations, banks are constantly improving their internal processes and spreading the risk culture across different business lines (e.g. finance and risk). To achieve this goal, firstly the management team creates appropriate reports.

These reports should indicate the risk and inform the business of that risk at the same time. By providing the reports institutions enable the business to appreciate their return compared to a global risk overview.

When it comes to the business side, gaining new clients or increasing assets per advisor are key drivers. A detailed management reporting shows where to focus on and in doing so helps increase the bank’s profitability. Furthermore, management reportings will also give you an answer to the most important questions such as:

- How to manage the advisor team efficiently?

- Who are the most profitable clients?

- What are the relevant client profiles?

- How to identify clients who need support?

Investment Reporting - Definition by function

With regard to the technical function of a reporting, a distinction is generally made between two forms: a) time-controlled and b) event-controlled reporting.

Time-controlled reporting

With this function, important key figures can be displayed over time. Depending on the target group and data basis, the desired information is displayed in relation to time sequences, previous year or monthly values, as well as a percentage or total changes.

Event-driven reporting

In contrast to time-defined reporting, this form only evaluates data that takes effect from a specific event. This can include reaching predefined threshold values or an insufficient number of agreed performances.

Fincite.CIOS - Software for a 360- degree Investment Reporting

As various as the types and beneficiaries of reportings are: the outcomes are all based on a standardized database. The linking of your customers’ security account data with market data, intelligent algorithms, and self-defined rules are basic functions of CIOS.Reporting.

A proven solution thanks to composable Software Engines

With CIOS.Reporting, financial institutions gain a detailed understanding of their customers, meet regulatory requirements (e.g. MiFID II), evaluate internal key figures such as customer satisfaction or revenue per advisor.

In addition, CIOS can be used to connect numerous market data providers in order to ensure consistent prices within the reporting. The portfolio consolidation in CIOS is performed at custodian bank level, which sets new standards in the field of asset aggregation.

Thanks to the multi-asset reporting, non-liquid (alternative investments) can also be included in the investment reporting to obtain a holistic view of client assets. Alongside its high scalability, CIOS also offers you a complete set of pre-defined analyses, including:

- Absolute risk and return metrics such as: VaR, expected shortfall, potential gain, expected upside, expected volatility, relative expected upside, expected tracking error. At portfolio and single asset level.

- Relative risk metrics vs benchmark or liabilities such as: relative VaR, relative expected shortfall, relative potential. At portfolio and single asset level.

- Basic Analysis: More than 150+ risk and return figures available of the shelf, possibility to include custom-build and even proprietary risk and return measures at your discretion.

- Advanced Analysis: Sensitivity analysis, stress tests, What-if analysis, scenario analysis

- Special reporting: ESG (based on environmental, social and government criteria)

Fast implementation – with CIOS banks can build on their existing IT landscape and do not need to replace it. Thanks to digital interfaces (API), the modular software connects to existing systems, extends their functionalities, and maps the findings in a modern frontend. Alternatively, data can be imported in CSV or XML and used as an input.

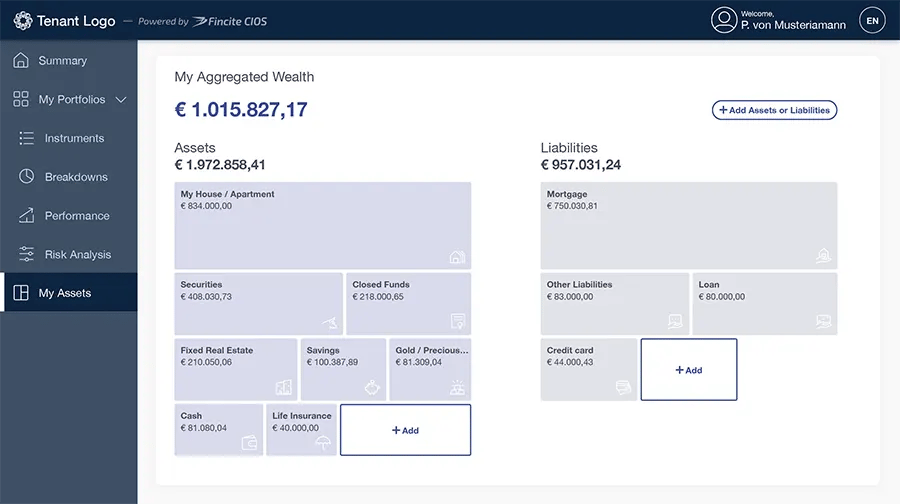

Client Reporting

Comprehensive reports, which can be generated from an individual dashboard, will help for a better understanding of your clients and gain deeper insights into their total assets. Also, they offer new occasions for a conversation and help you intensify the relationship with your customers.

CIOS.Reporting enables you to aggregate the total assets of your customers and present them in a well-structured dashboard.

Advantages of our reporting application:

- 360° view with real-time information about the total assets of your clients

- Clarity whether the risk diversification corresponds to the personal risk profile

- Regional focus on investments

- Distribution of total assets among asset classes

- Transparency on costs and fees

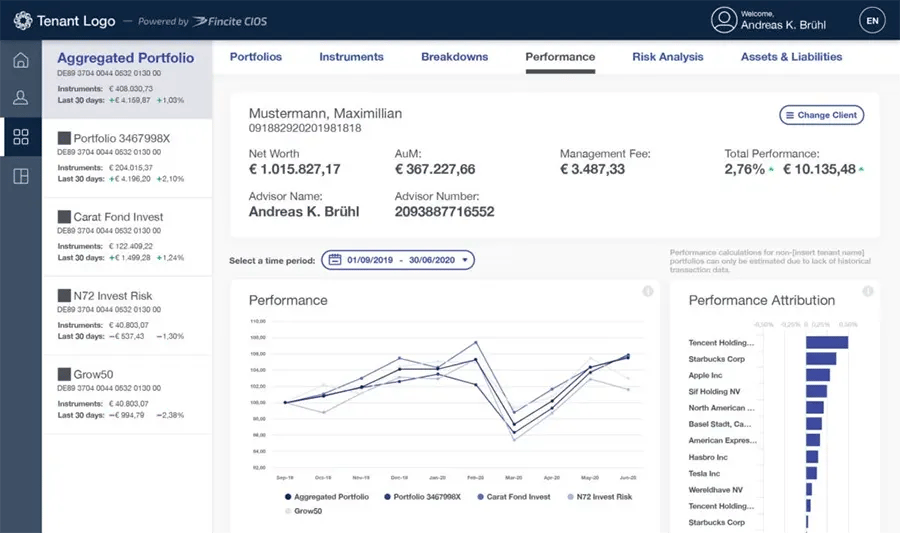

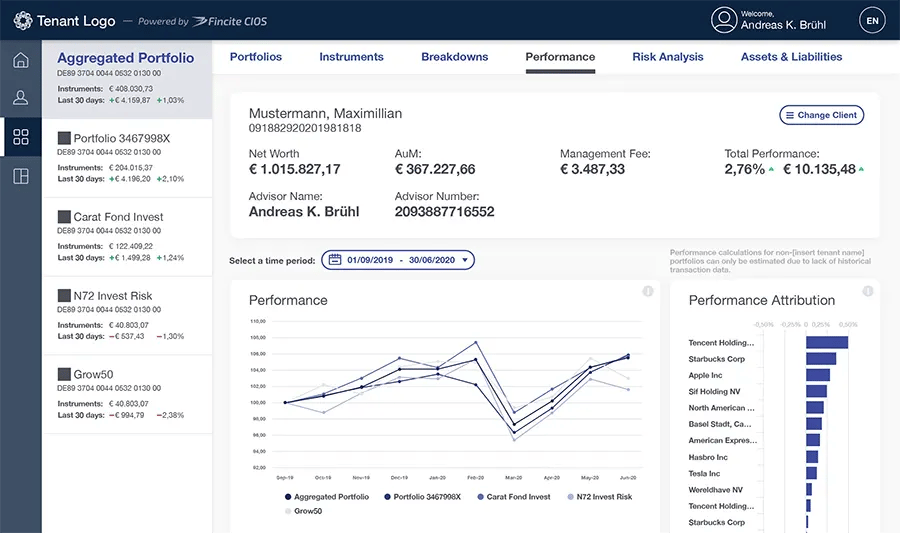

Advisor Reporting

The CIOS.Reporting reporting software gives advisors a digital toolbox to provide first-class financial advice. Thanks to the holistic overview of customer-related data, advisors can react quickly to market changes and give appropriate recommendations for their clients. The Software offers an intuitive overview of:

- Before-and-after portfolio comparisons

- Deeper insights into the customer portfolio (cross-selling)

- CRM data (name, telephone, etc. on request)

- Consolidated view of the customer relationship

- Risk classification (knowledge and experience, suitability protocol)

- Portfolio data at cumulative and individual securities account/account level

- List of transactions

- Individual restrictions

- Portfolio allocation charts, percentages, graphical representation

- List of instruments

- Cumulative performance (also against the benchmark)

- Aggregated assets

- Newsfeed (alternative investments, events, buy/sell recommendation)

Management-Reporting

With our management reporting application, financial institutions will gain important insights into the overall structure of their customers, the performance of their advisors or branches, and regulatory compliance.

The obtained information can be used to generate sales leads for advisors and execute sales initiatives.

CIOS.Reporting offers the possibility to create a tailor-made reporting based on six important pillars:

Products

- Structure of the portfolios

- Overview of product groups and asset classes

- Top products in stock

Customer Overview

- Statistics of top clients

- Early identification of customer risks

- Selection according to client size (AuM) and structure

- Per consultant or branch

- By performance

AuM

- Evaluation of assets and development per advisor or branch

- New assets incl. margin development or new customers

Compliance & Risks

- Status on compliance with regulatory standards, strategy conformity and bank requirements

- List of investment limit policy violations

Performance

- Of wealth management solutions,

- Portfolio managers and advisors as well as the most important clients

Earnings

- Overview per consultant/branch

- According to customer structure

- Benchmarking against targets

Download the free white paper for digitizing your investment reporting process.

”With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.”

Ronald Tuinenga, Product Owner Digital Investments ABN AMRO